Fund Commentaries

2nd Quarter 2024

Summary

- Performance

- Country Thoughts & Weightings

- Key Movements & Weightings

Performance

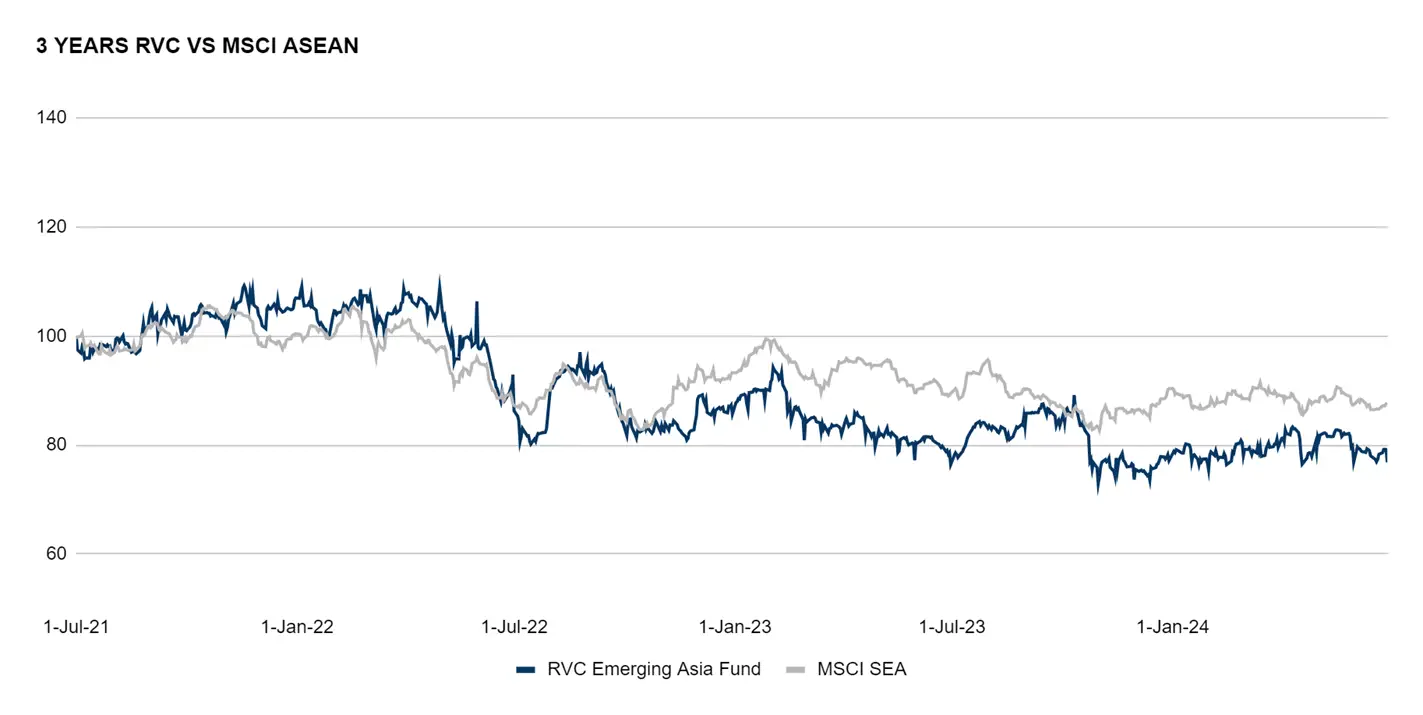

Year to date, the RVC Emerging Asia Fund returned -0.3%, versus the MSCI ASEAN which returned -3.3%

Over the past month, the RVC Emerging Asia Fund returned -0.7% versus the MSCI ASEAN which returned +0.4%.

Currency

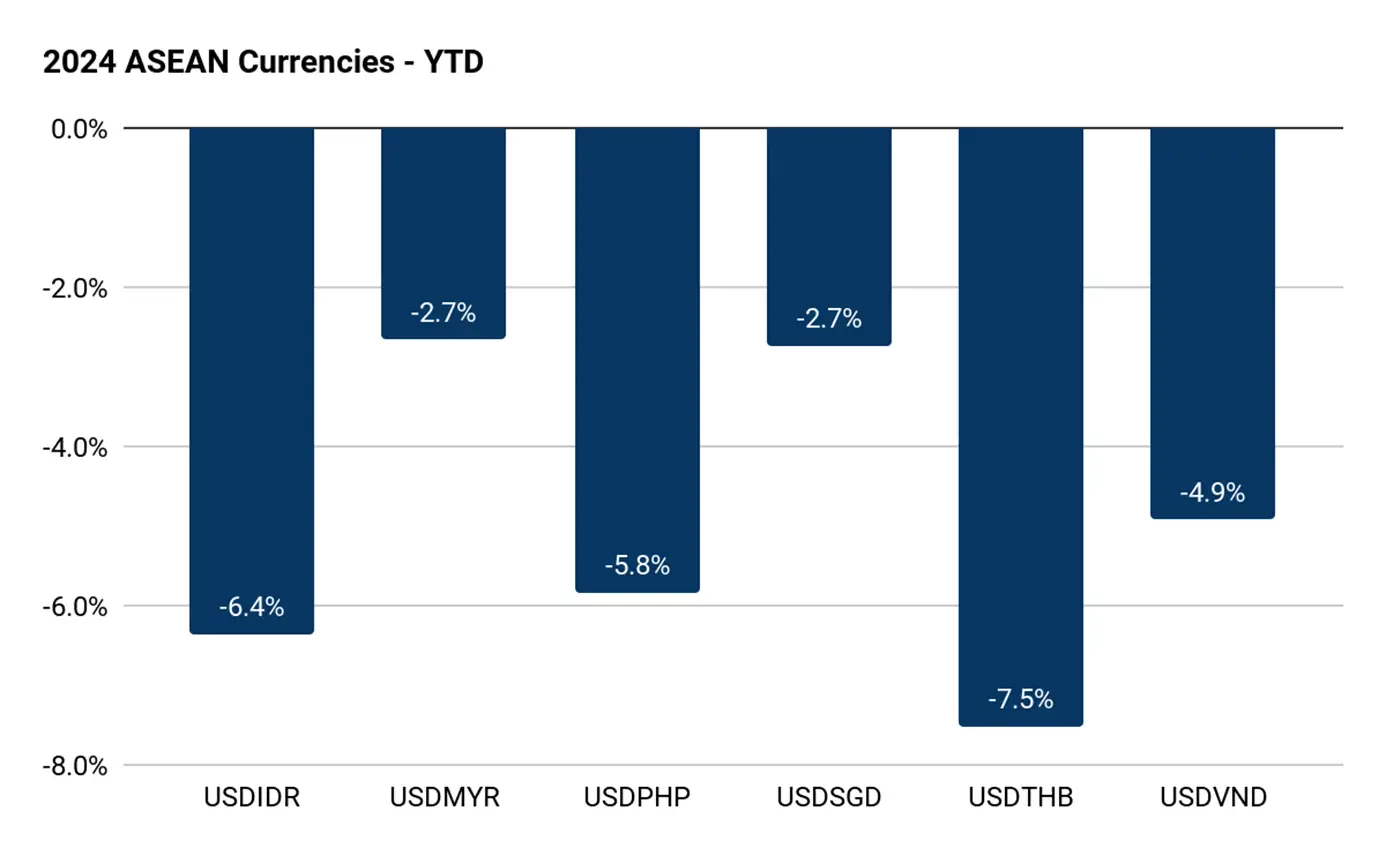

Currencies continue to be drag on performance, as of the end of June 2024, the “strongest performing currencies” are the Malaysian ringgit and the Singaporean Dollar which are both -2.7% for the year, and the weakest performing currencies are the Thai Baht, Filipino Peso and Indonesian Rupiah, ranging from -5.8% to -7.5%.

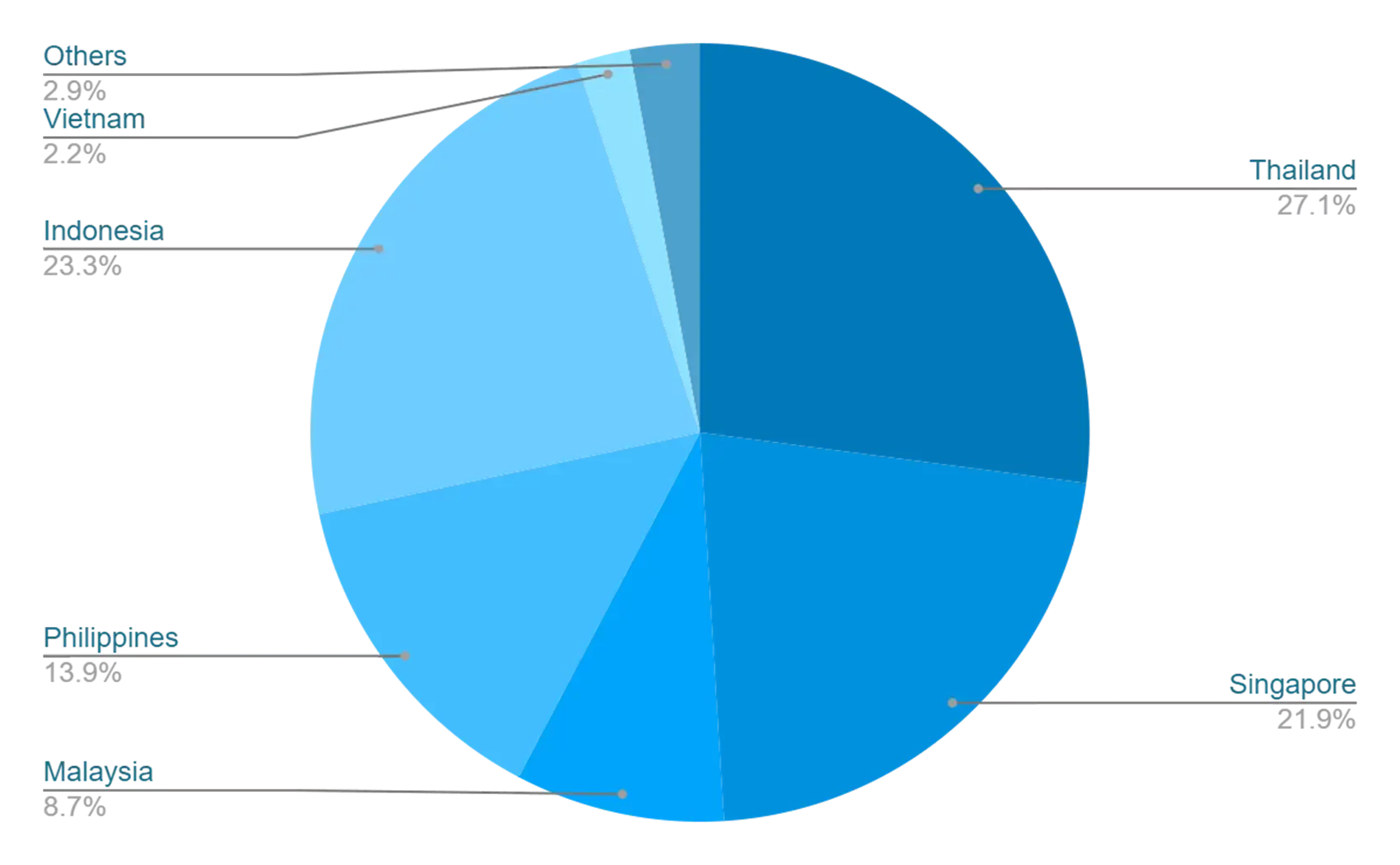

Country Thoughts & Weighting

Key Movements & Weightings

Key Movements

The key movements during the quarter were as follows:

Exits

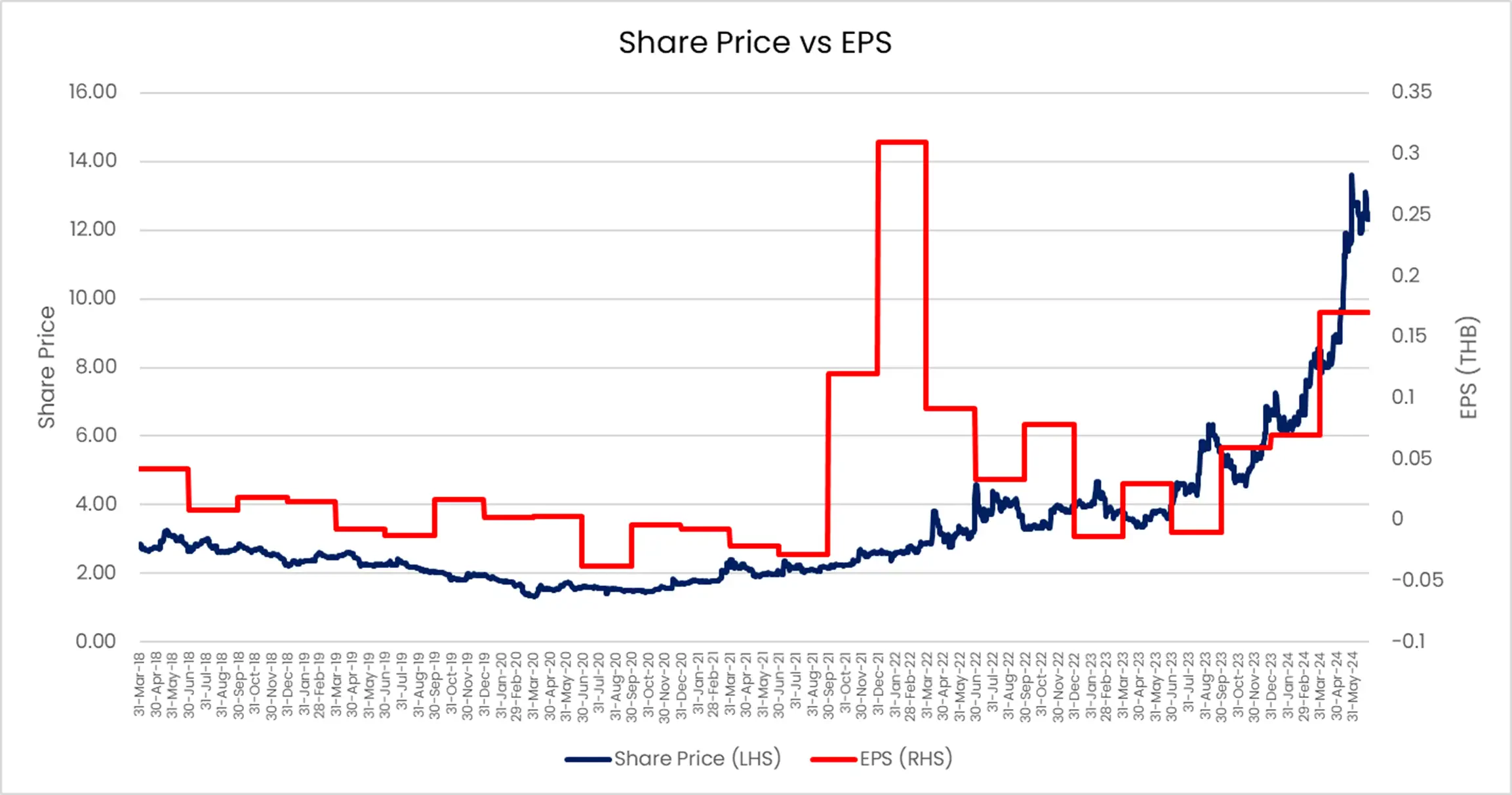

Wattanapat Hospital Trang PCL (WPH)

Mkt Cap: THB 6.9 bn/USD 190 mn

In the 2nd Quarter of 2023 we wrote about WPH being one of the potential multibaggers to hold for the coming year. We were fortunate that our fair value of this hospital company was achieved within 12 months, as the share price increased from THB 4/share to THB 12/share becoming 10% of the Fund, we completely exited the position within the quarter.

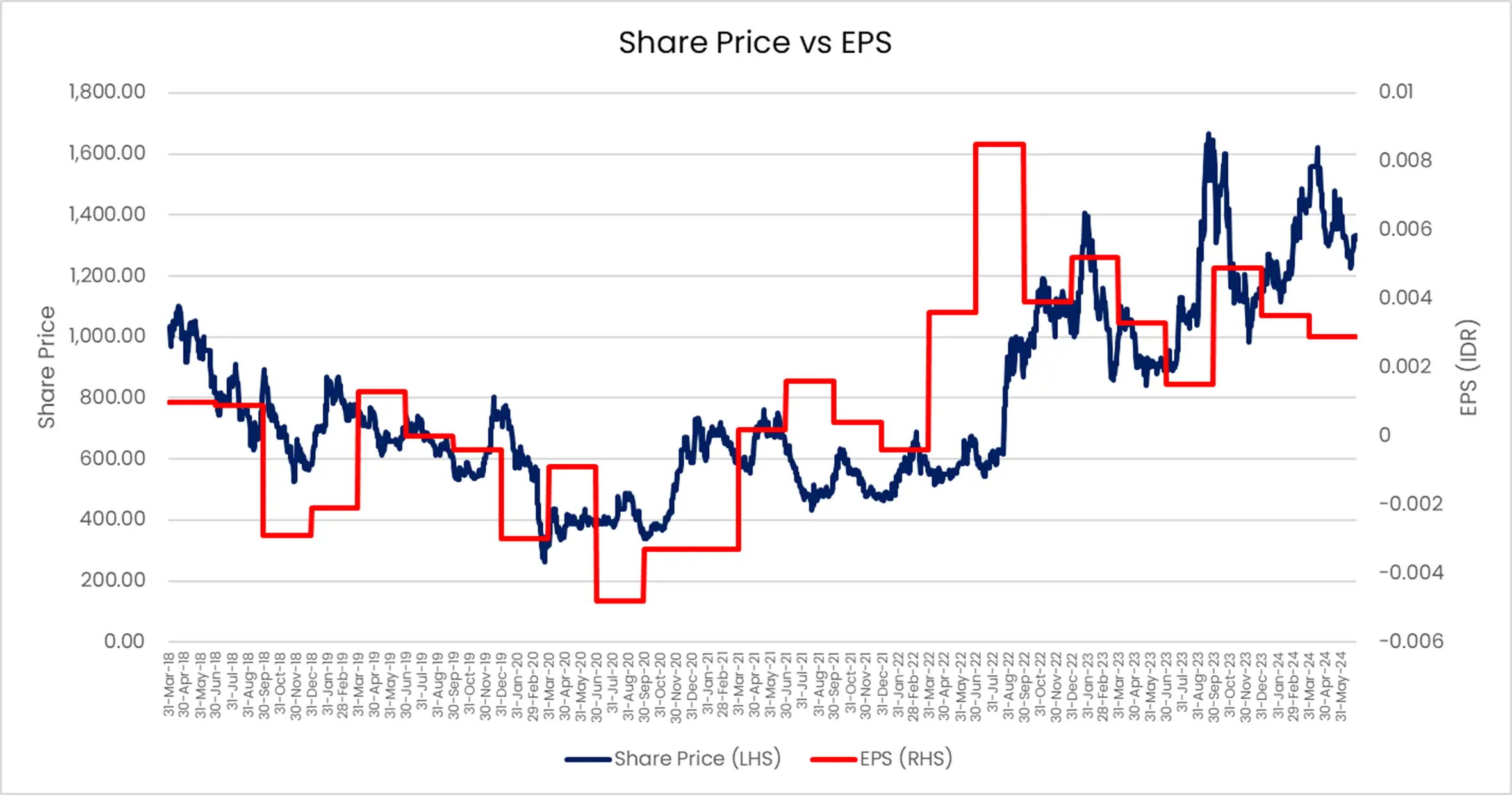

MEDCO ENERGI INTERNASIONAL TBK (MEDC)

Mkt Cap: IDR 32,048 bn/USD 2 bn

This is our second full exit for MEDC. The first purchase was during the 1H of 2023 and we exited in September and October 2023 for a +50% return, we re-entered MEDC in November/December 2023 with a 5% weighting and exited during the Quarter for a +35% as oil prices had rallied strongly. Should we find that the risk/return parameters of the key drivers of the business, combined with the share price being valued attractively will return as shareholders.

New holdings

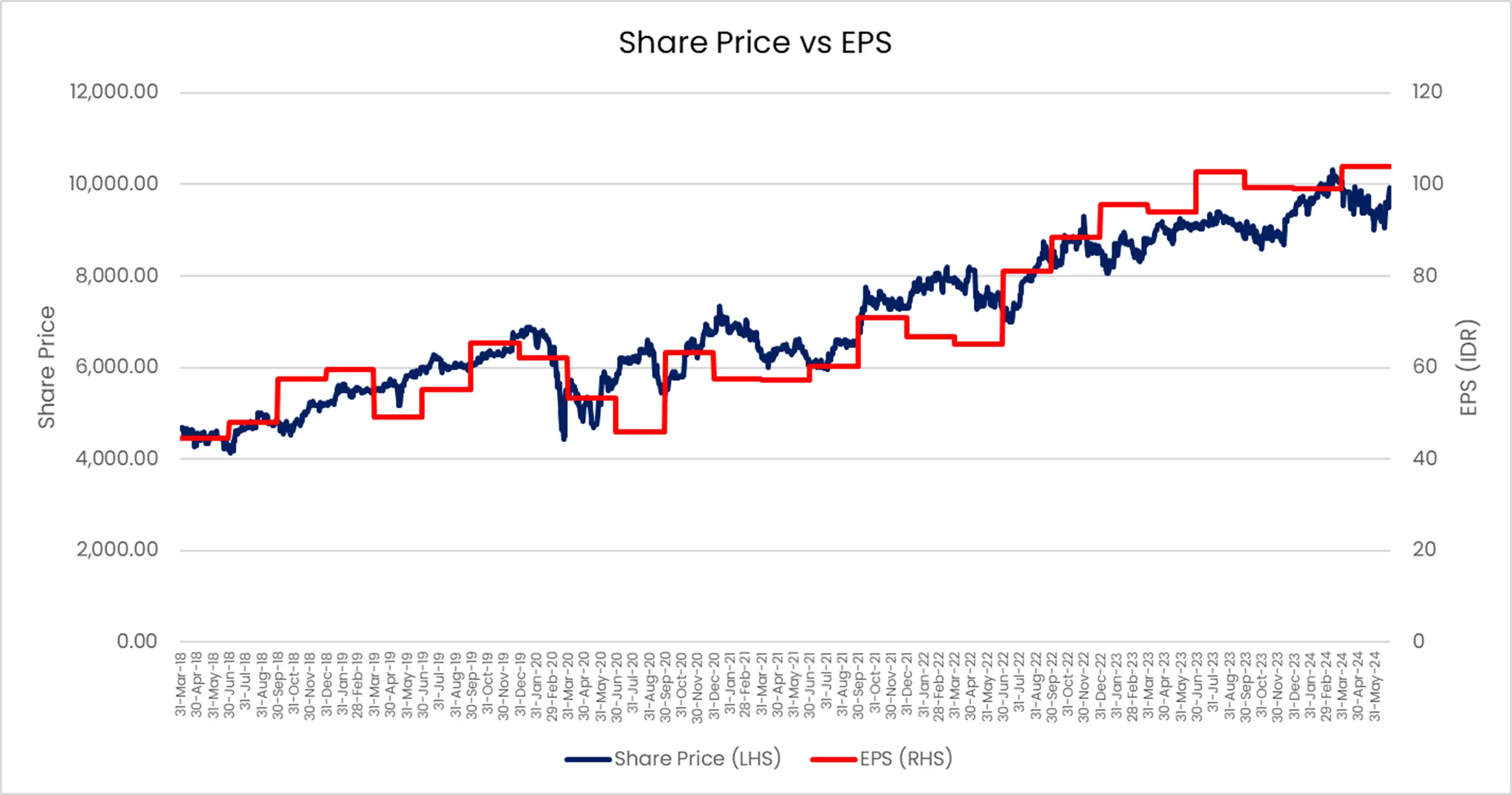

Bank Central Asia Tbk PT (BBCA)

Mkt Cap: IDR 1,279 tn/USD 73 bn

During 2Q24 the entire Indonesian banking sector had a strong sell off, predominantly due to BBCA’s peers. WQe took advantage of this latest sell off to accumulate a 4% weighting in the best performing bank in the country. As per the latest May 2024 figures, BBCA continues to demonstrate that it is the best bank in Indonesia, YTD May-2024 headline profit at IDR 21.6tn (+12% y-y), funding costs of 1.01%, far below below the rest at >2.5%, and given the BI’s upcoming further relaxation on reserve requirements (i.e., by giving a larger incentive for lending towards priority sectors), this could further improve system liquidity, thereby reducing funding costs pressures across banks. BBCA is likely to continue its energiser-bunny form of compounding growth in Indonesia.

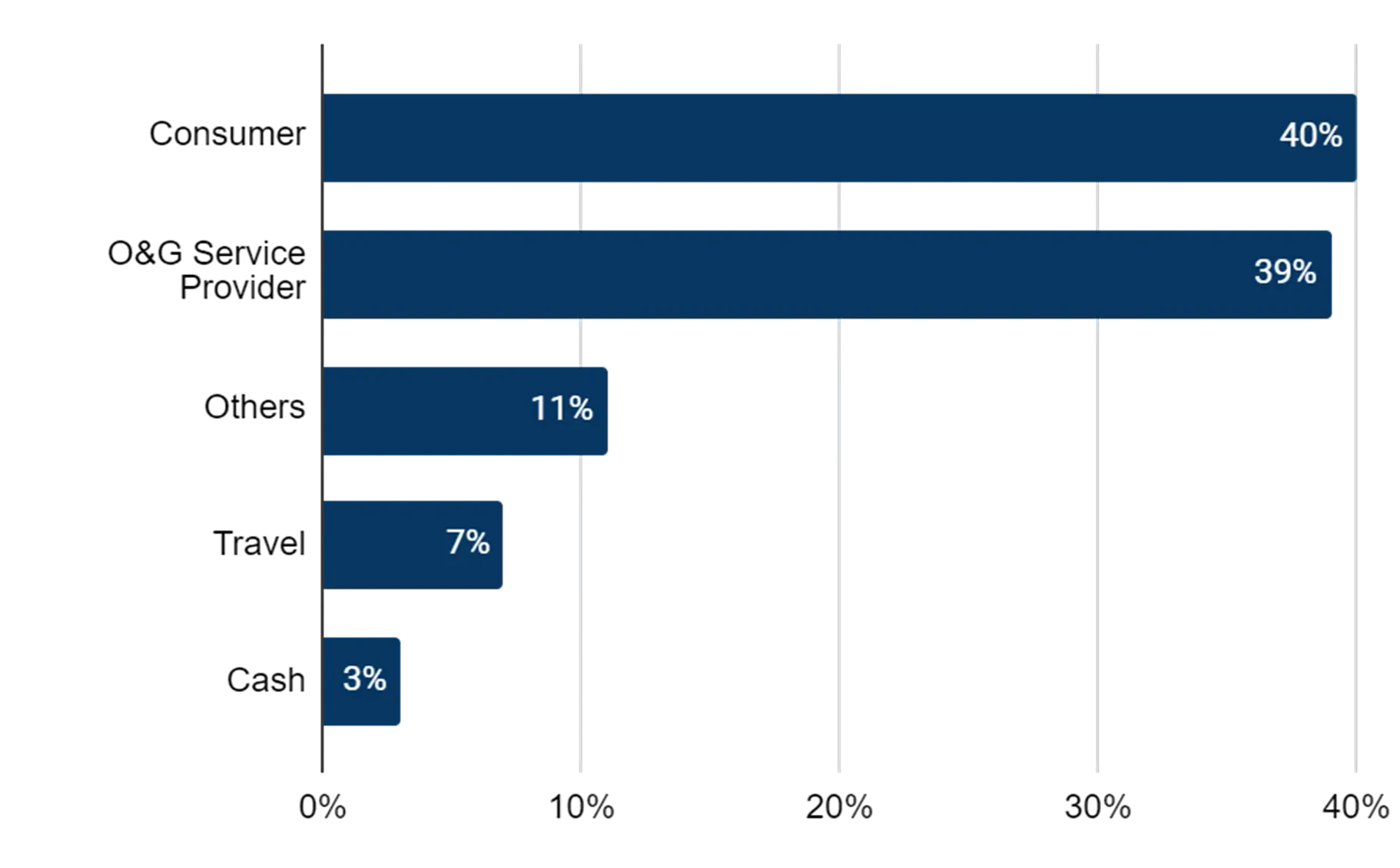

Weightings by Category

Top 5 Sector Weightings

Top 5 Positions (accounting for 37% of the Fund)

- VEB MK 7.8%

- MASTER TB 7.6%

- SIDO IJ 7.5%

- MPM SP 7.3%

- URC PM 6.6%

Tickers mentioned

- VEB MK - VELESTO ENERGY

- MASTER TB - MASTER STYLE PLC

- SIDO IJ - SIDO MUNCUL

- MPM SP - MARCO POLO MARINE LTD

- URC PM - UNIVERSAL ROBINA CORPORATION

- WPH TB - WATTANAPAT HOSPITAL

- MEDC IJ - MEDCO ENERGI INTERNASIONAL TBK

- BBCA IJ - BANK CENTRAL ASIA TBK