Fund Commentaries

3rd Quarter 2024

Summary

- Performance

- Country Thoughts & Weightings

- Key Movements & Weightings

Performance

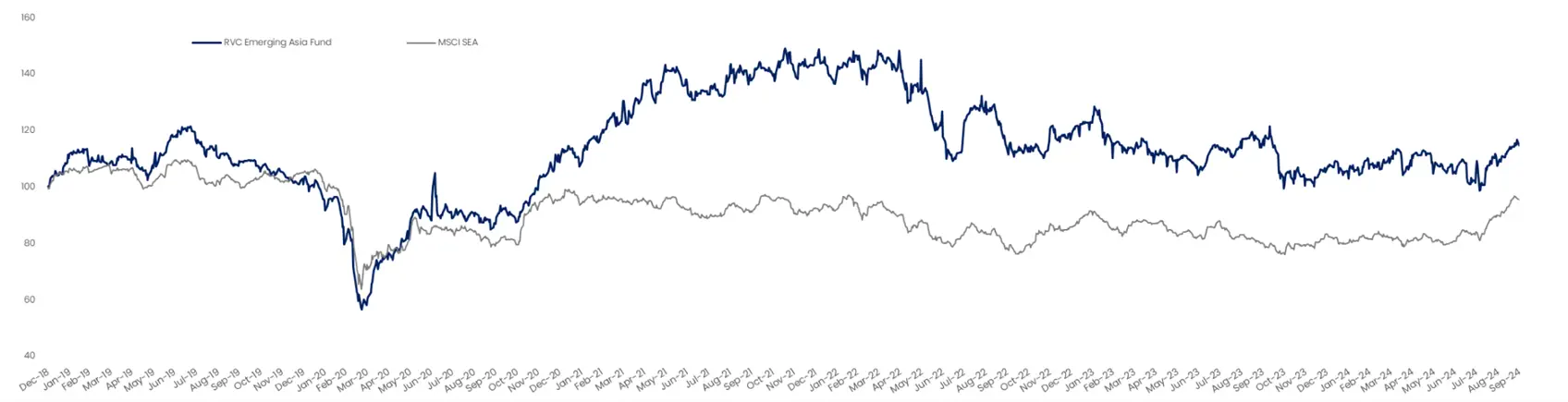

In the Third Quarter of 2024, the RVC Emerging Asia Fund returned +9.6%, bringing the Year-to-date return to +9.2%.

Since the end of 2018, the RVC Emerging Asia Fund is +15% versus the MSCI ASEAN at -4.3%.

Commentary

How would one describe the third quarter of 2024? Given the movements in equity markets in Japan, ASEAN, and China, equity markets are more volatile than Bitcoin, to the upside.

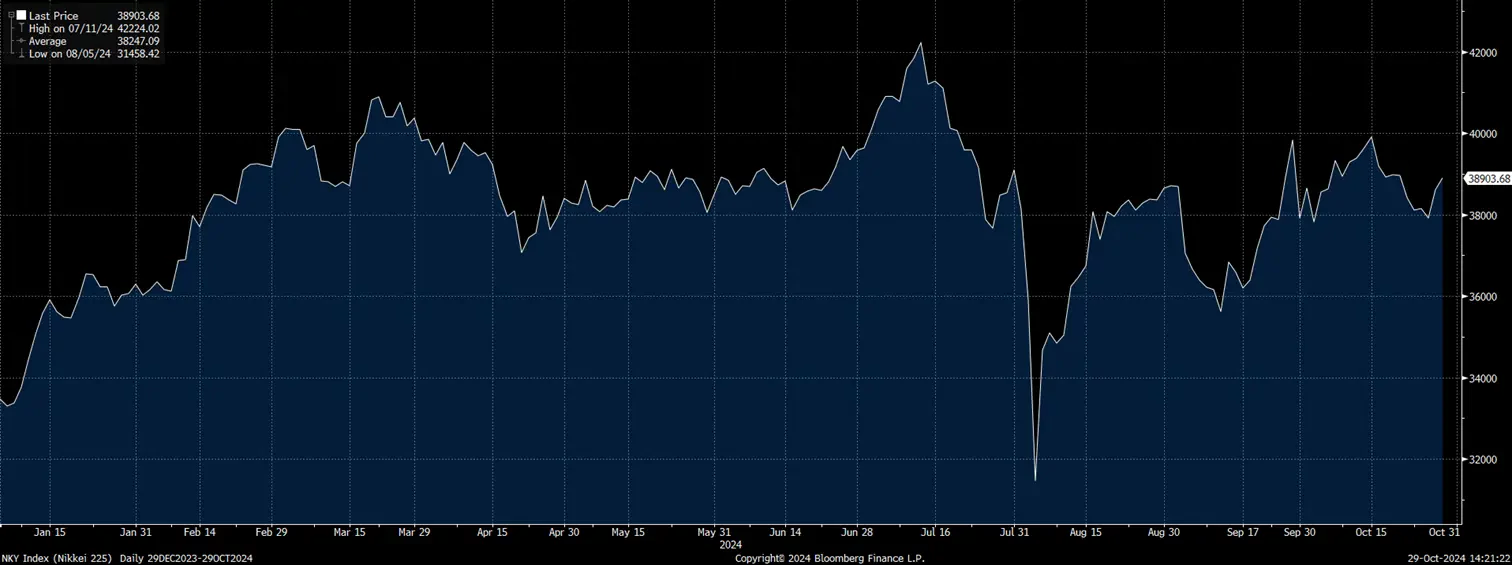

In August Japanese equities collapsed by -20% over a few days.

Figure 1: Nikkei 225 Index

This drop surprised us and given the risk that this may spread throughout Asian markets, we fully exited URC PM (4%) registering a small profit and to potentially further increase cash in the case of further equity market crashes throughout the region.

Thankfully this was not the case as shortly after the Japanese equity market crash, the US Federal Reserve announced a 50bps rate cut, and currencies in ASEAN strengthened by 3-10% within 6 weeks (see below). And for a brief period of time, ASEAN was an outperformer globally, following this development, China announced a raft of stimulus packages leading to Chinese and Hong Kong equities quickly overtaking the world as the best-performing equity markets for the period. Perhaps, after a decade, is Asia finally catching a bid?

Figure 2: MSCI ASEAN

These events led to ASEAN rallying strongly in August 2024 by +7%, and our performance caught up in September due to the performance of two Oil & gas service provider holdings, DMHL SP and BKM SP (explained below) increasing +50-70% in the third quarter, these two names more than offset the poor share price performance of MPM SP, CSE SP and VEB MK.

We have recycled these profits into new positions such as MYOR IJ, explained here, existing holdings and new positions that we will divulge as they grow in size.

Further, Thailand announced a USD 10 bn stimulus package which led to the country’s stock market going from being one of the worst in the world to +6% in USD terms for 2024.

A small trading position was taken in IVL TB (2.5%) in September at THB 20/share, which we subsequently exited for a +20% in the month. However, as of mid-October, we have re-added the position.

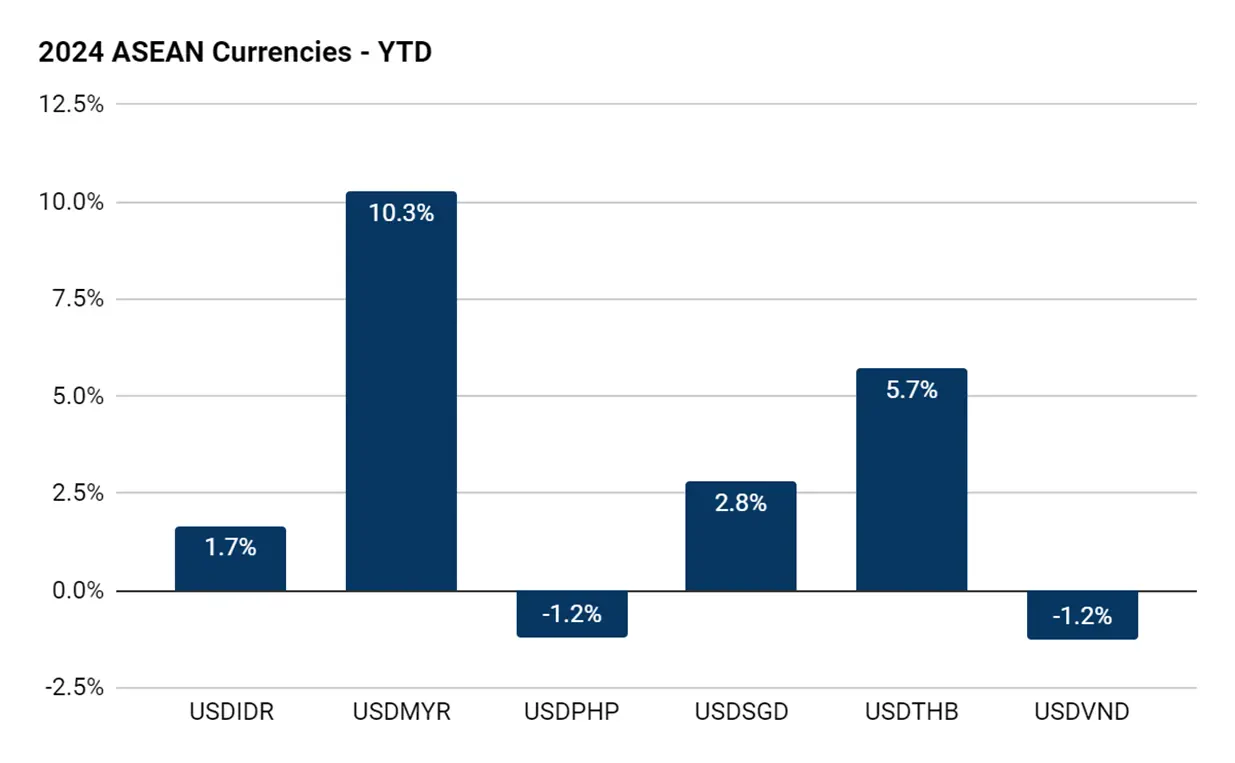

Currency

For the first time in 24 months, currencies are not a drag on performance, as of the end of September 2024, the strongest performing currencies are the Malaysian ringgit +10.3%, and the Thai Baht +5.7%, and the weakest performing currencies are the Filipino Peso and Vietnamese Dong both are -1.2% for 2024.

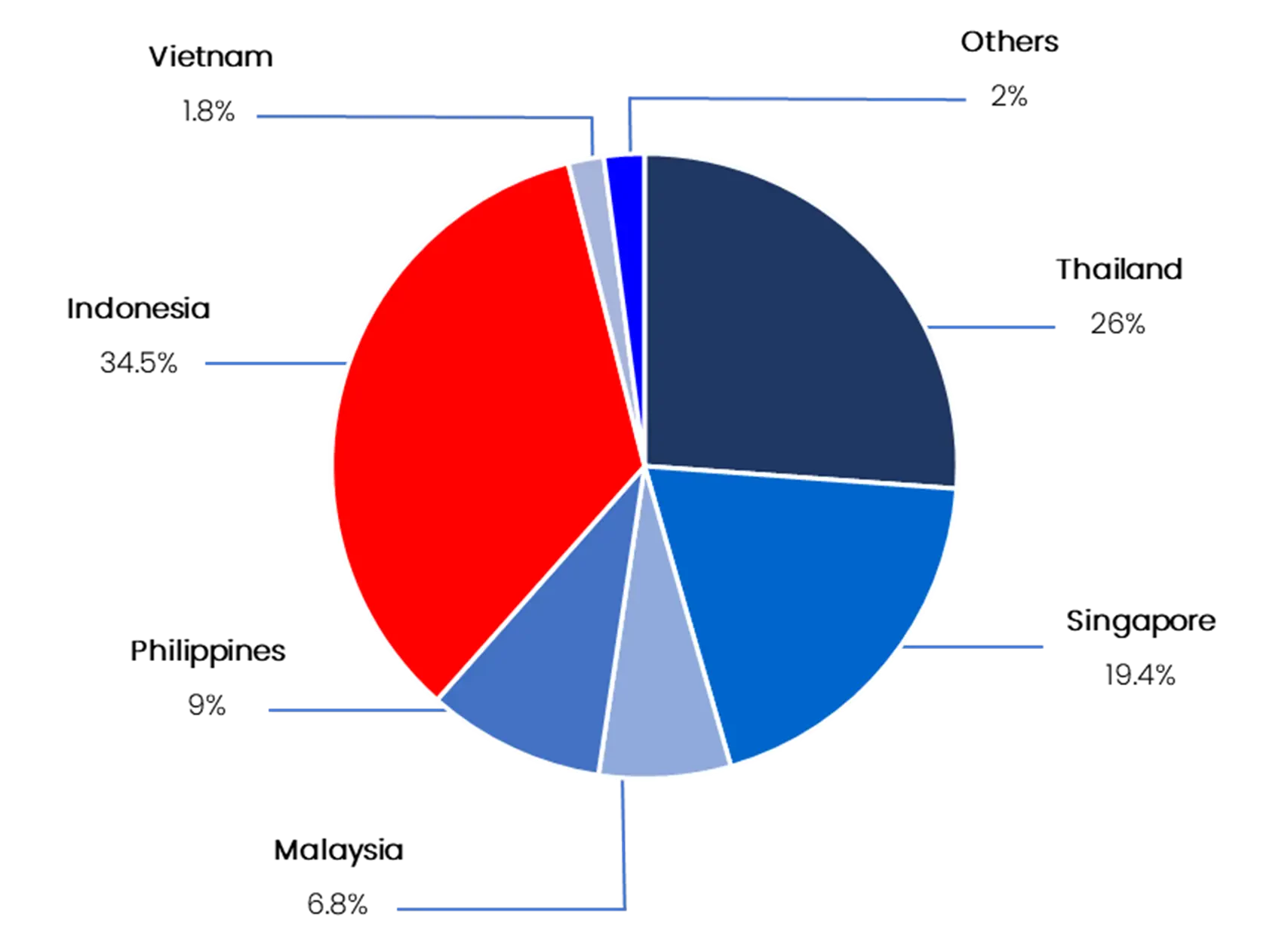

Country Thoughts & Weighting

Key Movements & Weightings

Key Movements

The key movements during the quarter were as follows:

Full Exits

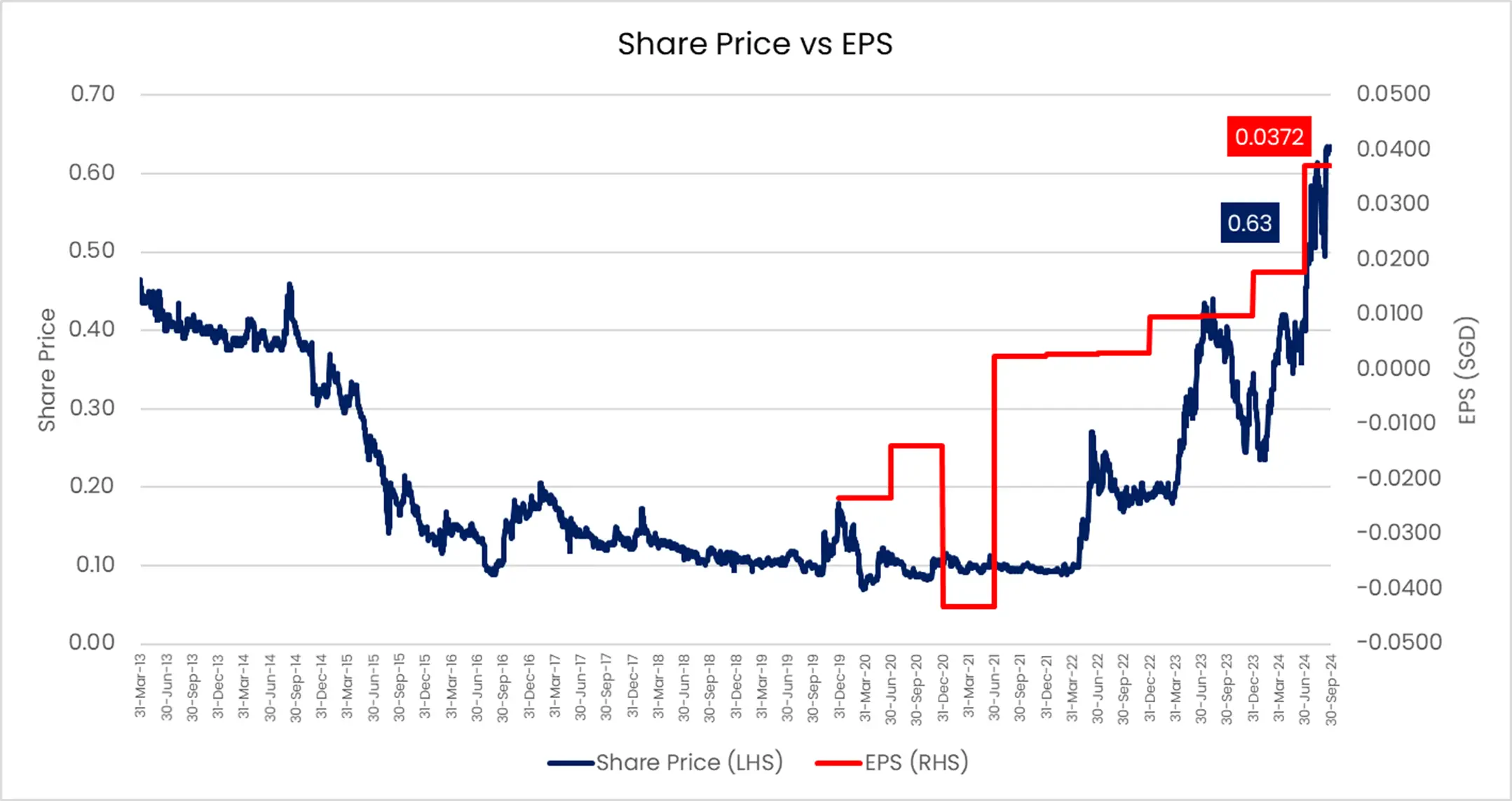

Dyna-Mac Holdings Ltd (DMHL)

Mkt Cap: SGD 767 mn/USD 586 mn

We first wrote about DHML in May 2024, on September 2024, Hanwha Group announced a tender offer for the shares of DMHL at SGD$0.60/share, initially a 3% holding of the Fund. Hanwha Aerospace and Hanwha Ocean intend to secure management control through the offer, having already invested KRW 116 billion ($86.9 billion) this May to secure a 25.4% stake in the company.

We estimate that DMHL is worth +20-30% above the acquisition price over the coming years, given the availability of other opportunities in the region we fully exited this position with a total return of +97% for a 6-month holding period.

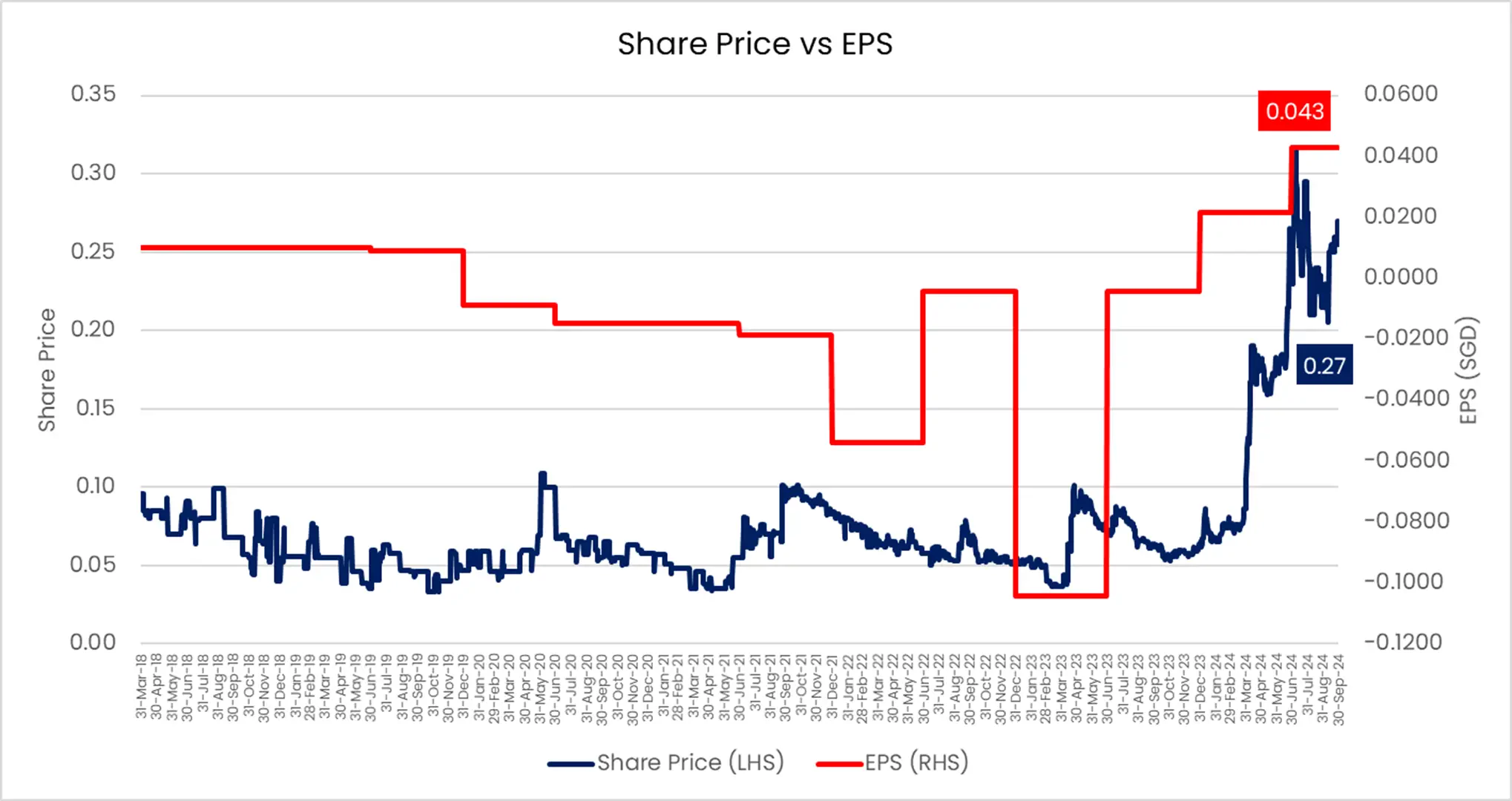

Beng Kuang Marine Ltd (BKM)

Mkt Cap: SGD 46.8 mn/USD 35.4 mn

A second oil & gas service provider listed on the SGX that we highlighted in May 2024, BKM SP, initially a 2.5% weighting, increased +76% from our cost price to ~SGD 0.25/share which we estimated to be a fair value for the next 18-24 months, we fully exited the position.

New Position

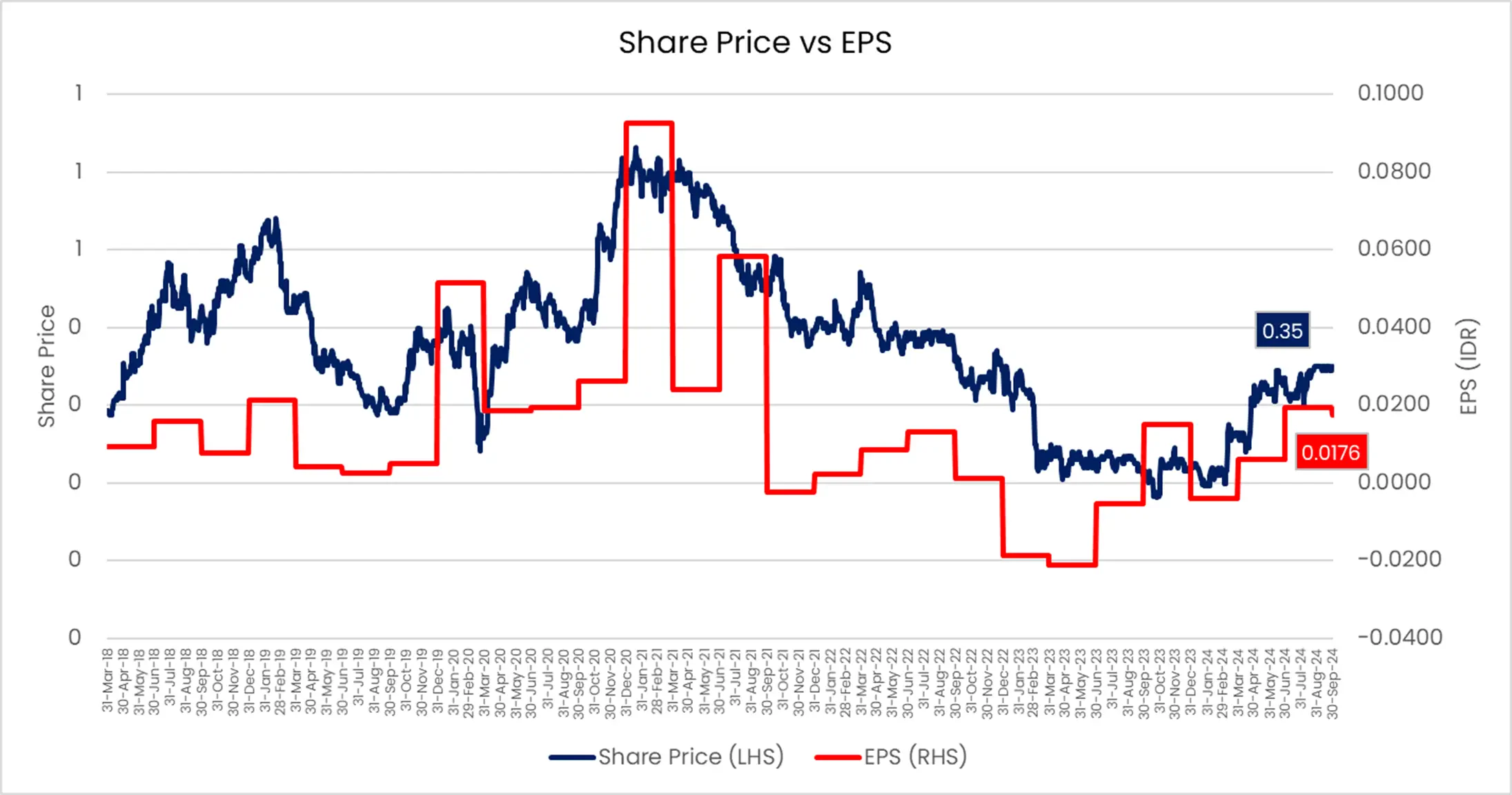

Japfa Ltd (JAP)

Mkt Cap: SGD 758.9 mn/USD 573.5 mn

JAP is a leading pan-Asian, industrial agri-food company that has an integrated network of modern farming, processing and distribution facilities in Indonesia, Vietnam, India, Myanmar and Bangladesh. They specialise in producing protein staples (poultry, swine, aquaculture, and beef) and packaged food. JAP SP holds leadership positions in Indonesia (#2, 21% Poultry Feed Production, 25% DOC Production), #1 Myanmar (31% Poultry Feed Production, #2 Doc Production 22%) and #2 in Vietnam with DOC production of 20%

During 2022-2023 the company was challenged with high costs of production leading to their operating margins declining from 8-9% to 2-3% leading to losses in 2023. However starting in 1Q24 these costs began declining thereby allowing margins to recover and profitability as well, this is further helped by generally higher poultry prices in Indonesia and Vietnam.

Today earnings are trending from a loss of $30 mn in 2023, to a potential profit of $100 mn in 2024, going forward quarterly profit may return to $80-100 mn.

Currently, the shares are trading at 6x PE 24 and an estimated 3x PE 25.

We began building a position in 2Q24 to 4.5% of the Fund.

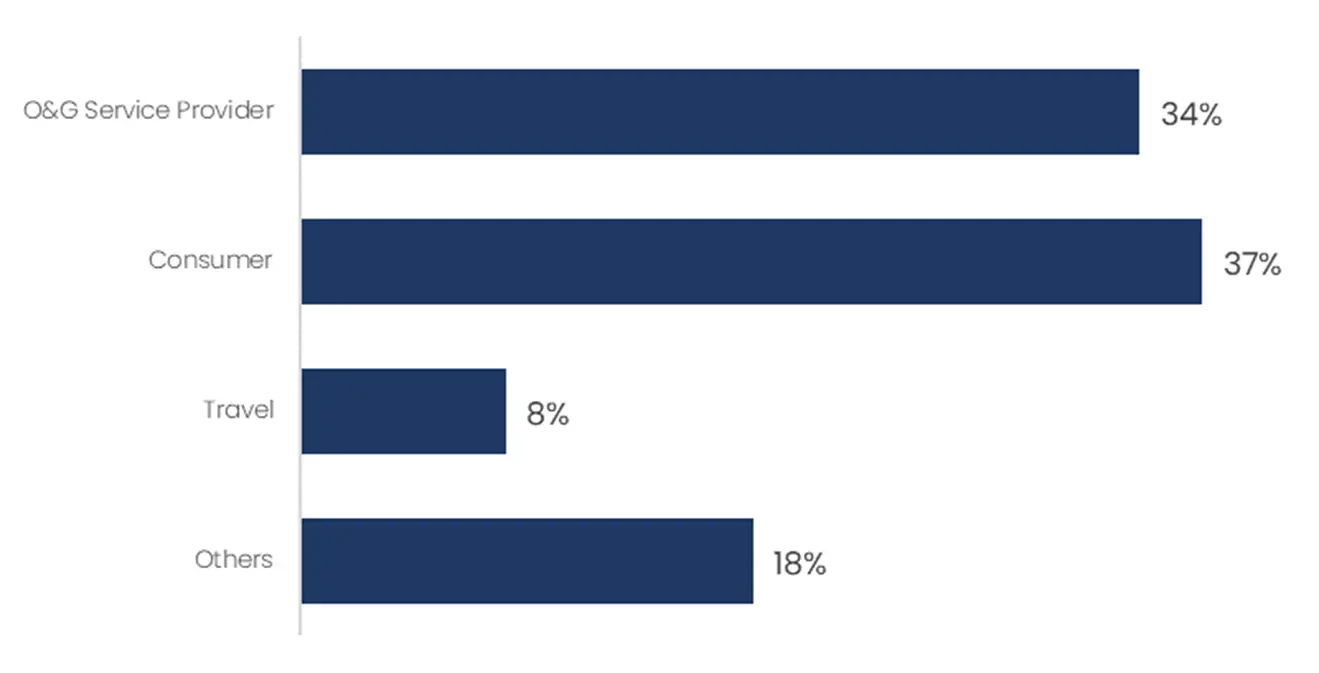

Weightings by Category

Top 4 Sector Weightings

Top 5 Positions (accounting for 37.5% of the Fund)

- ERAA IJ (7.9%)

- JMART TB (7.7%)

- CSE SP (7.6%)

- MPM SP (7.3%)

- MASTER TB (7%)

Tickers mentioned

- URC PM - UNIVERSAL ROBINA CORPORATION

- DMHL SP - DYNA MAC HOLDINGS LTD

- BKM SP - BENG KUANG MARINE LTD

- MPM SP - MARCO POLO MARINE LTD

- CSE SP - CSE GLOBAL LTD

- VEB MK - VELESTO ENERGY

- MYOR IJ - MAYORA INDAH TBK

- IVL TB - INDORAMA VENTURES PCL

- JAP SP - JAPFA LTD

- ERAA IJ - ERAJAYA SWASEMBADA TBK

- JMART TB - JAYMART GROUP HOLDINGS PCL

- MASTER TB - MASTER STYLE PCL