Fund Commentaries

4th Quarter 2024

2024

A year of two periods, in the first 9M24 the Fund was up +9.6%, where we exited several names. These include companies in the Oil & Gas offshore services, Beng Kuang Marine Plc (BKM SP), Dyna-Mac Plc (DHML SP) which returned nets of +25% and +50% within 6 month periods, followed by holdings in Thailand, Indorama Ventures (IVL TB) and Dusit Thani Hotels & Resorts Plc (DUSIT TB) at +25% and +40%.

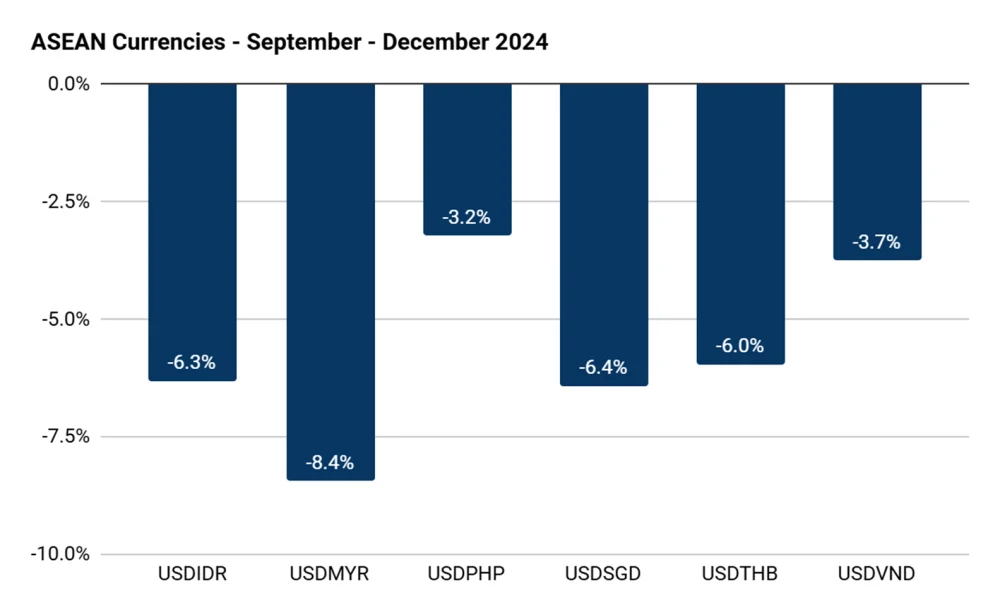

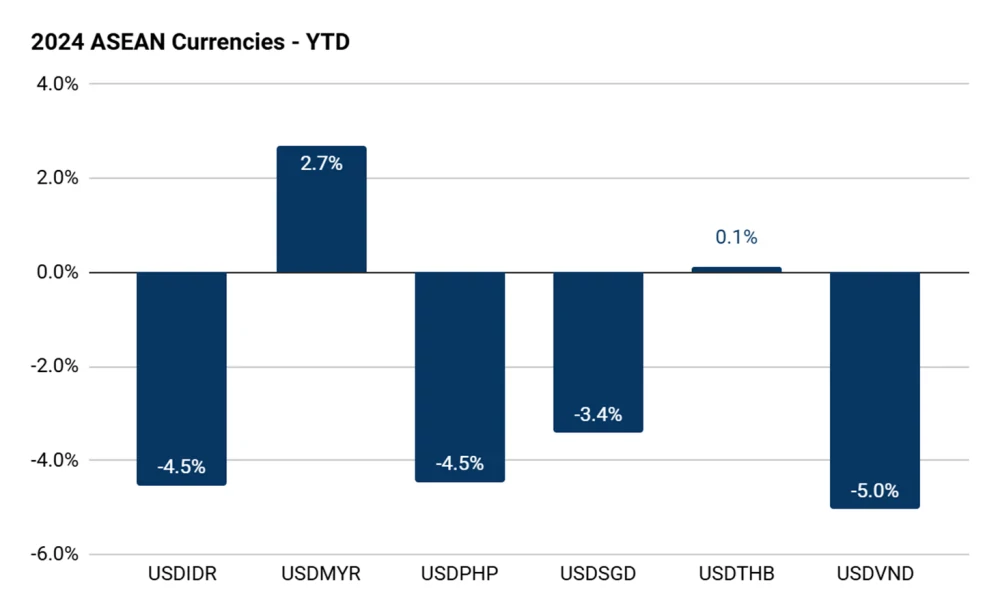

However, the 4th Quarter of 2024 was quite the bloodbath for ASEAN equities and our holdings, despite 95% of them reporting their 9M24 earnings above expectations and 80% of the Fund is at a PE 5x with CAGR growth rates of 20%, the Fund declined -14% due to all holdings share price prices declining and currencies working against us, to finish the 2024 calendar year -6.1%, a disappointing end.

Was the decline in the markets and currencies the Trump effect? Fears over tariffs?

I hold to the viewpoint that Trump’s presidency is more positive than negative as there is

1) A high probability of the ongoing wars in Europe and the Middle East will pause/be settled, this leads to less loss of lives, a lower cost of business, improved supply chains, reduced uncertainty leading to higher confidence to owners and management to expand one's business.

2) During Trump’s first presidency currencies, generally, were stronger versus the US Dollar.

3) A continuation of continued FDI into ASEAN. Over the past decade over $1.75 trillion of FDI has come into ASEAN as the China + 1 strategy accelerated, this is a polar opposite of capital market flows. These FDI flows will naturally lead to improved economic activity within the region.

Outlook for 2025

Speaking primarily for our holdings, 2024 operating performance for our holdings has been fantastic and we expect for their earnings growth to continue.

Commentary on holdings is expanded upon below, but the positive outlook is due companies such as ASSA IJ and JMART TB proving turnarounds in performance in 2H24 provides confidence for continued growth in 2025, holdings such as SPOST SP which is likely to pay out dividends equivalent to market capitalisation over the 2 years and market share dominance of MASTER TB and MYOR IJ with high revenue growth are all positive indicators for outperformance.

Amidst the current weakness in markets is providing opportunities to re-enter, or increase our positions in current holdings.

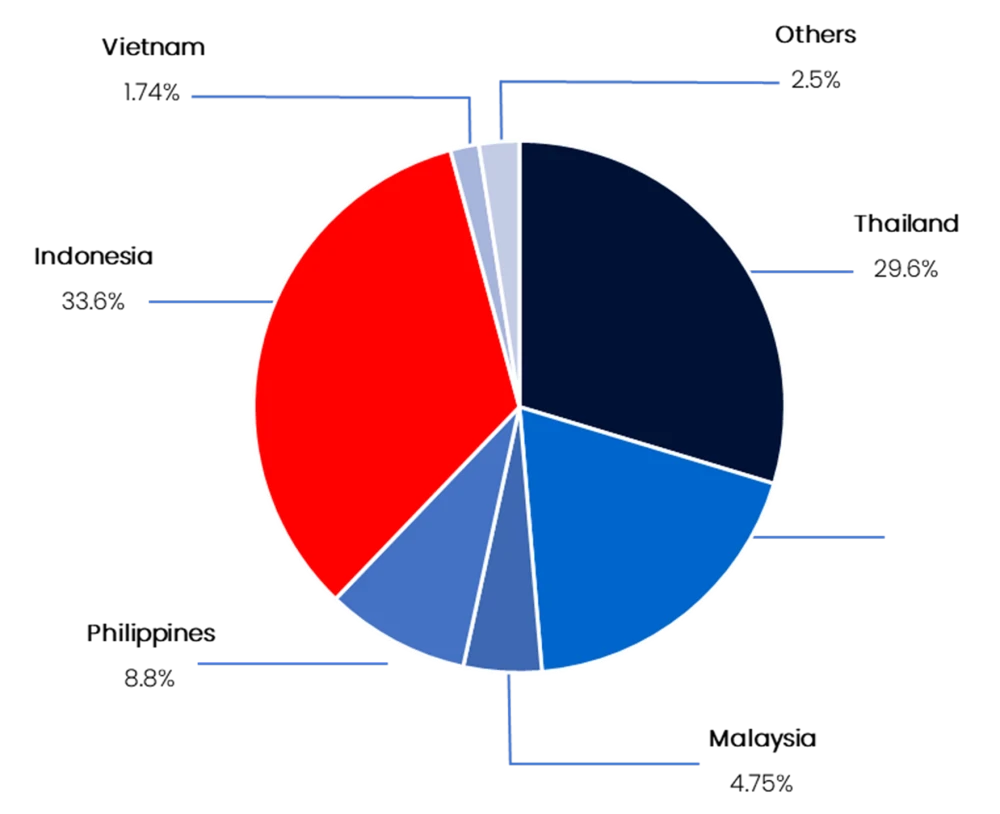

Country Weighting

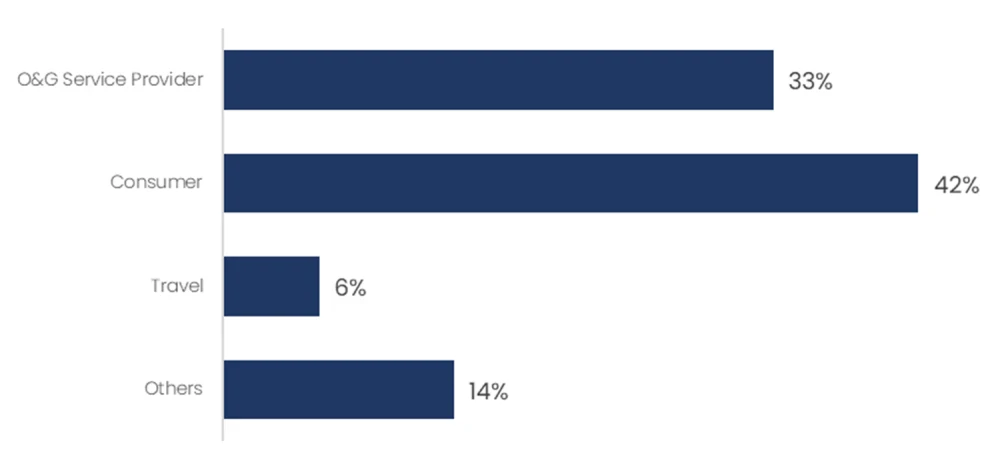

Sector Weighting

Currencies

September - December 2024

YTD (2024)

Holdings update

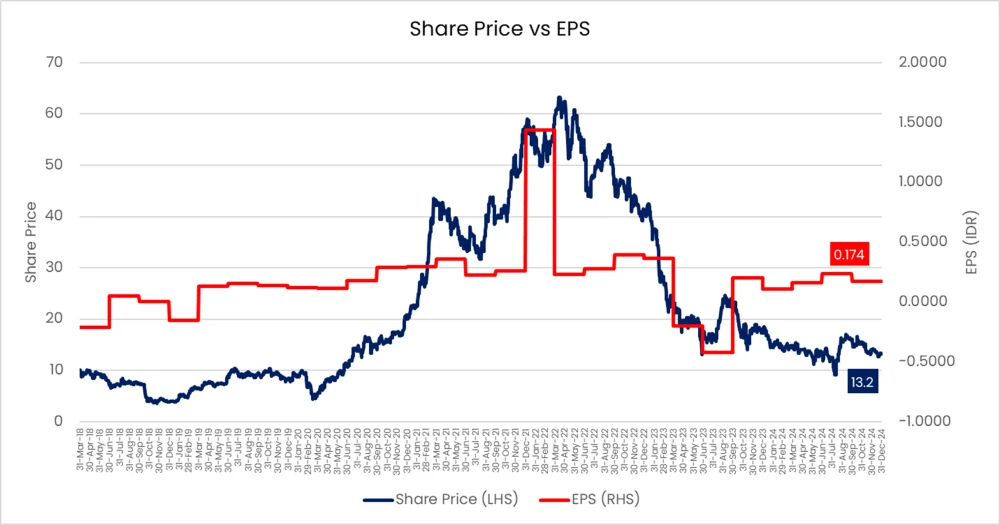

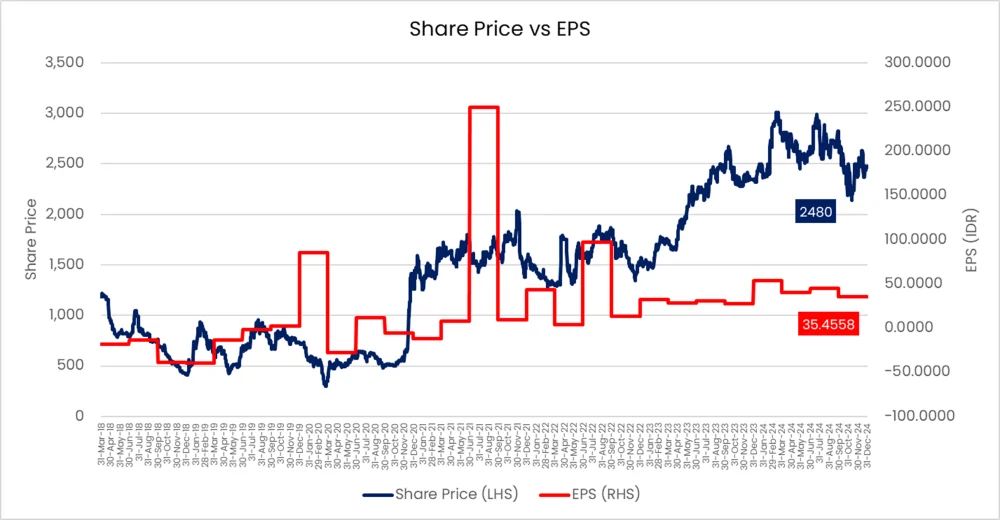

Adi Sarana Armada Tbk PT (ASSA IJ) - Market Cap. IDR 2.4 trn; USD 149 mn

Indonesia’s Fast-Moving Consumer Goods (FMCG) market has experienced significant growth, expanding from IDR 540tn in 2015 to an estimated IDR 1,040tn in 2024, representing a CAGR of 7.6%. This surge in demand has driven parallel growth in the logistics sector, which has expanded from IDR 44tn in 2015 to IDR 85tn in 2024 at a 7.7% CAGR. Transportation remains the key cost driver in FMCG distribution, highlighting the operational intensity of the sector. Adi Sarana Armada (ASSA IJ) is well-positioned to benefit from this growth as a key player in integrated logistics, offering fleet management, warehousing, and fulfillment solutions tailored to FMCG companies.

The Indonesian automotive market presents mixed dynamics, with a continued weakness in the four-wheeler (4W) segment but strong performance in two-wheelers (2W) and electric vehicles (EVs). In the first ten months of 2024 (10M24), 4W wholesales declined by 15% YoY to 710k units, with the total wholesale value contracting by 10.6% YoY to IDR 261tn. In contrast, 2W sales showed resilience, growing by 2.9% YoY to 5.87 million units, while EV sales surged by 170% YoY to 31.8k units, achieving a 4.5% penetration rate. October 2024 marked a positive inflection point, recording the highest monthly wholesales of the year. The shift from new to second-hand vehicles presents a strategic opportunity for ASSA to capitalize on the growing used car market and evolving aftermarket trends.

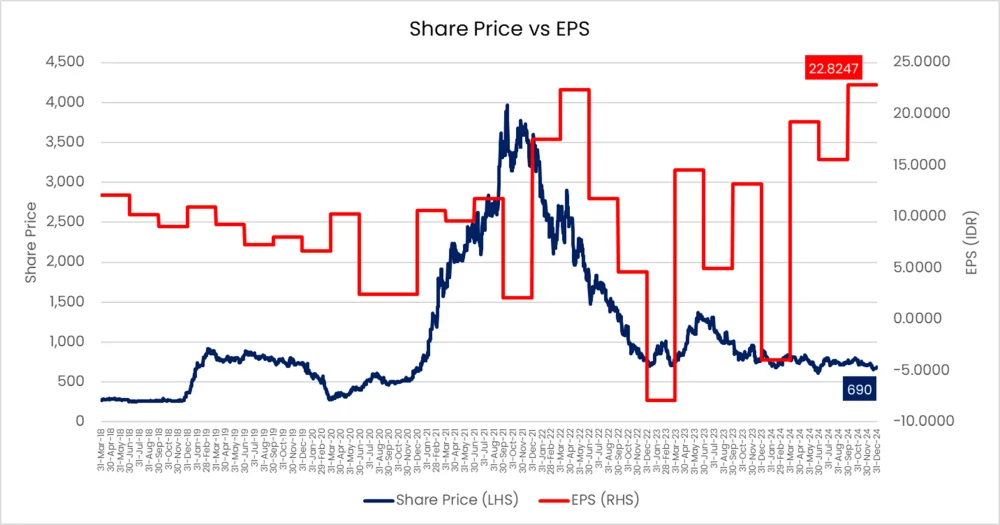

ASSA delivered a record-breaking financial performance in 3Q24, posting a net profit of IDR 84bn, reflecting a robust increase of 46% QoQ and 89% YoY. Revenue grew by 19% YoY to IDR 1.3tn, primarily driven by the strength of its rental car business. ASSA Rent maintained stable revenue at IDR 518bn (+4% QoQ), indicating steady demand for vehicle rentals. The company’s EBITDA rose by 58% YoY to IDR 409bn in 3Q24, with a cumulative 9M24 EBITDA of IDR 1.1tn (+37% YoY). Gross profit margin (GPM) improved to 31% (compared to 28% in 2Q24), reflecting effective cost management and a favorable business mix. Additionally, Return on Equity (ROE) strengthened to 7.6% from 5.9% in 2Q24, demonstrating enhanced profitability across its business lines.

ASSA’s investment outlook remains promising as its end-to-end logistics solutions continue to yield results, supported by an expanding client base. The company presents an attractive valuation with a projected P/E ratio of 7x for 2025 and 5x for 2026. Given its positioning in Indonesia’s fast-growing FMCG logistics sector, diversified revenue streams, and cost-efficient operations, ASSA is well-placed to maintain strong profitability. The resilience of its rental and used car segments provides downside protection amid weaker 4W sales, making it an undervalued stock with a compelling growth story.

Erajaya Swasembada Tbk PT (ERAA IJ) - Market Cap. IDR 6 trn; USD 372 mn

The Ministry of Manpower has issued Regulation No. 16/2024, mandating a 6.5% minimum wage increase in 2025. This will likely elevate retailers' base salary costs, though the extent of impact will depend on factors such as the proportion of minimum-wage or contract employees and the flexibility of companies to adjust total compensation, including bonuses and incentives. Among retailers, ACES appears the most exposed, whereas MAPA is the least affected, based on salary expenses as a proportion of total revenue and net profit.

For ERAA IJ, recent developments indicate potential upside from Apple’s expansion in Indonesia. On December 19, 2024, the Indonesian government, led by President Prabowo, approved Apple’s proposal, which includes expanded investments. As part of this commitment, Apple’s supplier will establish an AirTags production plant in Batam, initially employing 1,000 workers. This plant is expected to account for 20% of global AirTag production, leveraging Batam’s free-trade zone status, which offers exemptions from value-added and luxury taxes, as well as import duties. Additionally, Apple will invest $1 billion to set up a Bandung plant for accessories production and further develop Apple academies to train local talent in coding and other tech skills.

Despite these positives, uncertainty remains regarding the iPhone 16 launch in Indonesia. Apple must fulfill its remaining investment commitments before restrictions can be lifted, including establishing an R&D division in Indonesia, integrating the country into its global value chain by producing six identified components locally, and expanding the Apple Academy initiative. At present, there is no clear timeline for these commitments, posing uncertainty over when the iPhone 16 will officially launch in the country.

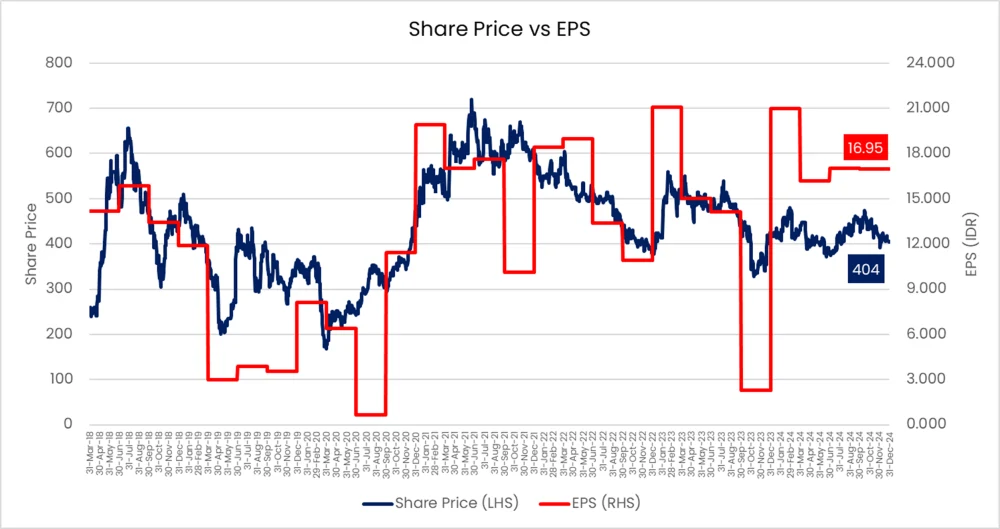

In terms of financial performance, ERAA posted 3Q24 revenue of Rp15.5tn (+11.3% YoY), though growth slowed compared to 2Q24’s +16.8% YoY due to weaker mobile and tablet sales (+9.7% YoY; -9.3% QoQ). However, other product categories gained traction, with revenue reaching Rp3.2tn (+17.7% YoY; +9.9% QoQ), accounting for 20.7% of total sales (vs. 17.7% in 2Q24). Notably, computer & electronic devices sales surged +125.9% YoY, while accessories & others grew +13.2% YoY. For 9M24, ERAA’s cumulative revenue of Rp48.6tn (+13.5% YoY) met 73% of consensus expectations, aligning with its three-year average seasonality of 71%.

On the margin front, 3Q24 gross profit margin (GPM) expanded to 12.0% (+145bps QoQ; +191bps YoY), supported by an improved handset product mix, a higher revenue contribution from accessories, and a recovery in operator product margins. However, operating expenses as a percentage of revenue rose to 9.4% in 3Q24 (vs. 8.0% in 2Q24 and 8.5% in 3Q23), largely due to higher fixed overhead costs related to store expansion, increased rental and salary expenses, and a sharp rise in inventory provisions (Rp71bn; +126% YoY; +189% QoQ) for clearing older models. Despite these costs, operating margin (OPM) remained stable at 2.6% QoQ (+102bps YoY), which is still better than the typical 3Q seasonal decline of -82bps QoQ.

On the bottom line, ERAA posted a 3Q24 net profit of Rp268bn (+640% YoY; -0.1% QoQ) and 9M24 net profit of Rp791bn (+60% YoY), exceeding 83% of consensus expectations (compared to the three-year average 9M seasonality of 66%). Promotional support remained high at Rp60bn in 3Q24 (-27.5% QoQ) and Rp189bn in 9M24 (+196% YoY). Meanwhile, a declining effective tax rate (21.8% in 3Q24 vs. 25.7% in 2Q24) provided an additional boost to net profit.

On the expansion front, ERAA opened 177 new stores in 9M24, on track to meet its FY24 target of 200 stores. However, net store openings slowed to 66 in 9M24, down from 360 in FY23, reflecting a more selective expansion strategy focused on higher-margin store formats. One major milestone was EraBlue, ERAA’s joint venture (55% ownership), which achieved breakeven for the first time in 3Q24. The business saw 9M24 revenue surge to Rp916bn (+528% YoY), while 3Q24 revenue grew to Rp354bn (+587% YoY; +10% QoQ). Improved productivity led to EraBlue reporting its first-ever quarterly net profit of Rp205mn, demonstrating improved economies of scale and asset turnover rising to 1.9x in 3Q24 (vs. 0.5x in 3Q23).

From a valuation perspective, ERAA currently trades at 4x PE for 2025, 0.8x PBV for 2025, or a 1x PE for 2027, suggesting an attractive entry point given its strong execution, improving profitability, and upcoming Apple-related catalysts.

In summary, ERAA presents a compelling investment case, benefiting from Apple’s expansion in Indonesia, solid revenue diversification, and improving margins. However, near-term risks include uncertainty around the iPhone 16 launch, rising wage costs, and higher operating expenses. That said, the stock remains undervalued relative to its growth potential, with further upside possible as Apple meets its investment commitments and ERAA continues to expand profitably.

Union Auction (AUCT TB)- Market Cap. THB 4.3 bn; USD 125 mn

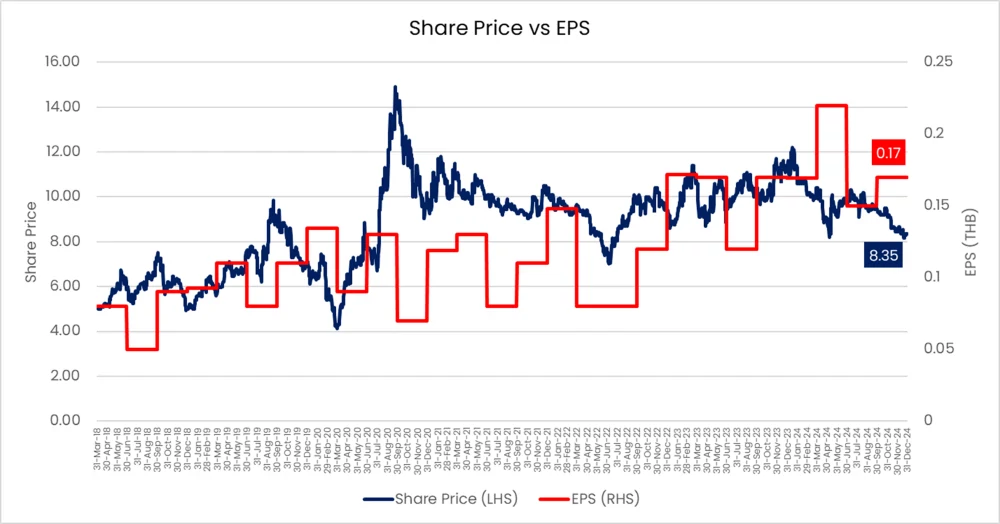

AUCT TB delivered a stable performance in 3Q24, with profits flat year-over-year (YoY), increasing +11% quarter-over-quarter (QoQ), and up +16% YoY for the first nine months. The company maintained strong profitability, with a gross profit margin (GPM) at 50% and a net profit margin (NPM) at 28.4%, demonstrating its ability to sustain high margins despite market challenges.

Revenue from services came in at THB 325.17 million, marking a slight 0.5% YoY decline, while auction revenue increased by 0.1% YoY to THB 278.36 million, reflecting an 8.8% QoQ growth. Revenue from transportation and additional services declined 4.1% YoY and 4.2% QoQ, reaching THB 46.81 million. For the nine-month period of 2024, the company’s service revenue totaled THB 972.70 million (+7.7% YoY), while auction revenue grew 9.2% YoY to THB 824.03 million. Revenue from transportation and additional services remained largely unchanged at THB 148.67 million (+0.1% YoY), supported by an increased volume of vehicles received and auctioned.

AUCT continues to benefit from Thailand’s weak economy, as financial distress drives more vehicles into the auction market. However, growth potential is somewhat constrained by strict lending standards from financial institutions, which limit used-car buyers’ access to financing. This trend is consistent with the broader slowdown in new car sales, which dropped 25.3% YoY over the first nine months of 2024. Despite this, household debt remains high, and vehicle-title-backed loans continue to expand, indicating sustained demand for liquidity. These macroeconomic conditions create both challenges and opportunities for AUCT, reinforcing its role in the auction business.

The company’s return on equity (ROE) now stands at 79%, highlighting its strong capital efficiency and profitability. It’s trading at 8x PE 2025 paying out a 9% dividend yield.

Marco Polo Marine LTD (MPM SP) Market Cap. SGD 206 mn; USD 150 mn

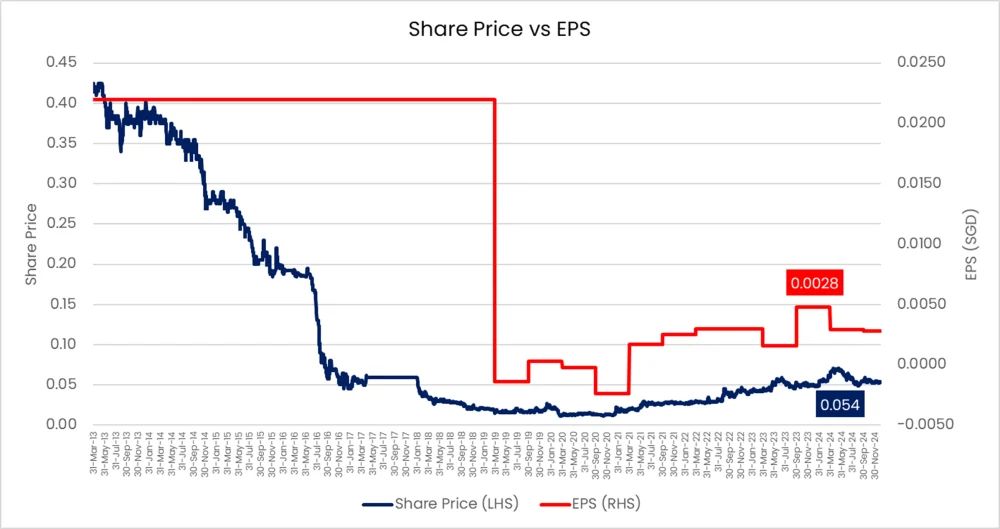

MPM SP reported a 2.8% YoY decline in FY24 revenue to SGD123.5m, primarily due to a drop in repair and maintenance revenue caused by the delay of its CSOV. Excluding unrealized FX losses from outstanding receivables and a SGD1.7m one-off provision for the CSOV delay, core PATMI would have risen 4.4% to SGD26.3m, in line with expectations. Despite this temporary setback, MPM is entering an exciting phase of growth, with its CSOV 91% completed and expected to start operations by March 2025. Utilization for the first two years is projected to be close to 95%, with charter rates averaging USD50,000/day. Additionally, charter rates across the industry are expected to rise by 5-10% in 2025, further boosting revenue potential.

The manpower shortage issue that impacted third-party repair volumes in 3QFY24 has also improved, with repair capacity utilization rising from 50% to 75%. This trend should continue into FY25E, supported by the expansion of its 4th dry dock, which is expected to drive a 25% revenue increase from April 2025 onwards. The company’s CTV operations are also contributing to profitability, with existing vessels operating at USD8,000/day. MPM is expected to expand its fleet with 1-2 additional CTVs by end-2025, bringing the total to 4-5 vessels.

With the CSOV nearing completion, MPM is well-positioned for significant earnings growth. While some operational challenges may arise in the first 6-8 months of deployment, the vessel should achieve stable operations by FY26E, making a substantial impact on the company’s bottom line. At just 6x FY25E P/E, with a net cash position, below-book valuation, and 30% expected earnings growth in 2025, MPM remains an attractive investment.

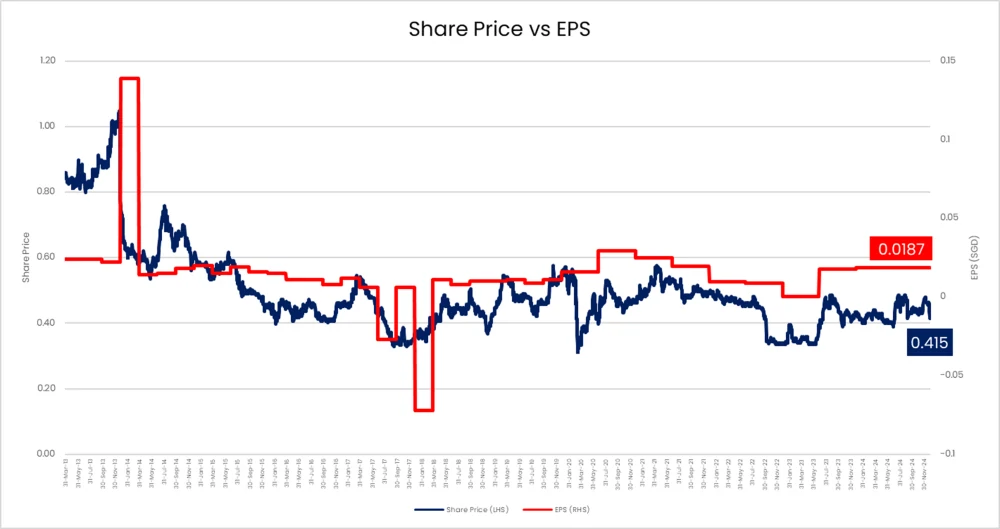

CSE Global Ltd (CSE SP) Market Cap. SGD 300 mn; USD 218 mn

CSE Global has increasingly pivoted towards electrification projects in recent years. However, the revival of activity in the Oil & Gas (O&G) sector could mean that all three of CSE’s business segments are now positioned for growth. This could significantly enhance CSE’s order book and profitability going forward. As of 9M24, orders from the energy sector declined 3.7% YoY to SGD 237m, but with the potential policy shifts under a Trump administration, we anticipate a drastic rebound. Trump has pledged to approve new drilling, pipelines, refineries, power plants, and nuclear reactors, while also slashing red tape to accelerate energy sector expansion. This could drive a surge in O&G-related projects, benefiting CSE, which has historically had significant exposure to O&G developments in the US.

CSE intends to reinvest proceeds from asset sales into a larger property in the US, likely built in phases to capitalize on the substantial growth opportunities in electrification. This expansion aligns with increasing demand from US data centers and utilities. Additionally, CSE may explore new states with better tax incentives, further strengthening its position. The new facility is expected to be more than double the size of its existing property, which currently spans 16.68 acres with 215,474 sqft of building space.

With US O&G activity expected to surge, the mid-term outlook remains intact, as CSE’s diversified business model positions it well for growth across both electrification and O&G sectors. Valuation-wise, FY25 earnings growth is expected to reach 50% YoY, with a PE 2025 of 8x and an attractive dividend yield of 6.5%.

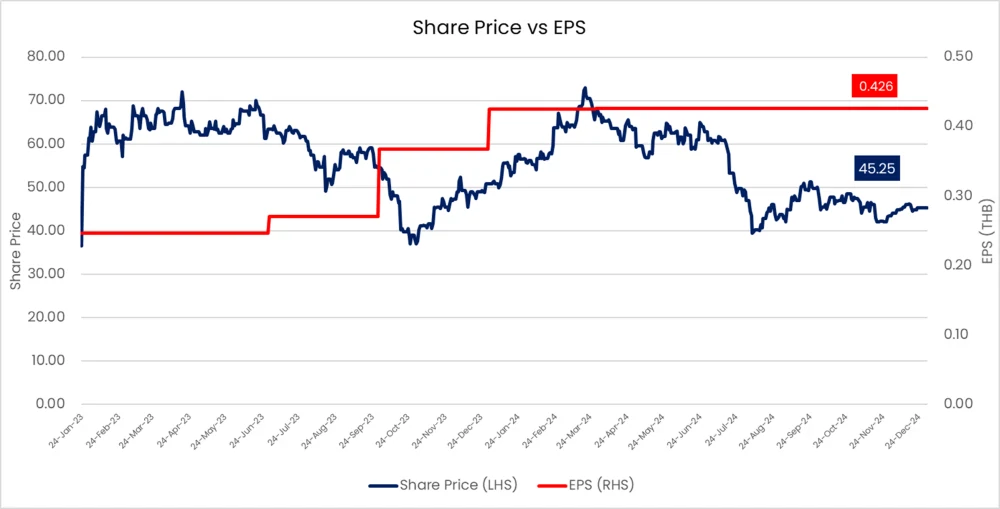

Master Style (MASTER TB) Market Cap. THB 14 bn, USD 403 mn

MASTER TB is a leading cosmetic surgery hospital in Thailand, operating under the well-established Masterpiece brand for over a decade. The company benefits from strong brand recognition and reputable medical specialists, positioning itself at the forefront of Thailand’s growing cosmetic surgery market. According to Grand View Research, the sector is expected to expand at a 9.6% CAGR from 2022 to 2030, driven by increasing domestic and international demand for high-quality yet affordable procedures.

MASTER reported 3Q24 revenue of THB522mn, representing a 9% YoY and 2% QoQ growth. Key revenue contributors include Surgery (+46% YoY), Hair (-5% YoY), Skin (-2% YoY), and Aftercare (Flat YoY). Operational hours increased to 11,702 hours (+7% YoY, +1% QoQ), reflecting growing demand. The proportion of Thai to international patients shifted to 69%:31% in 3Q24, compared to 76%:24% in 3Q23, highlighting the rising contribution from foreign patients. Among international patients, the highest revenue contributors were Indonesia (38%), Myanmar (12%), Cambodia (11%), and Others (39%).

Gross profit margin (GPM) remained strong at 57% in 3Q24, slightly lower than 58.2% in 3Q23 and stable compared to 2Q24 (57.0%). The YoY decline was due to a shift in product mix.

Thailand ranks third in Asia for medical aesthetic surgery and treatment tourism (Tourism Authority of Thailand). MASTER is leveraging this position by targeting foreign patients through increased marketing, partnerships, and agent expansion. Foreign patient revenue as a percentage of total revenue has grown significantly from 5% in 2021 to 26% in 9M24. The company aims to accelerate foreign patient acquisition, particularly in Indonesia, Laos, Cambodia, Myanmar, and Singapore. Recently, MASTER signed an MoU with Lumeo Health, a Jakarta-based agency specializing in cosmetic surgery and medical tourism. Lumeo Health, with seven years of experience, has achieved 84% YoY revenue growth and over 1,000 annual surgery referrals.

With foreign patient revenue growing 19% YoY in 9M24, MASTER's expansion strategy appears well-timed. Indonesia, the top contributor to foreign patient revenue, saw an impressive 105% YoY growth in 9M24, whereas Thai patient revenue increased only 6% YoY.

To accommodate rising demand, MASTER expanded its major surgery rooms from 7 to 17 in June 2023. However, utilization stood at only 55% in 3Q24, based on a 14-hour operating day. Increasing foreign patient volume should help optimize capacity usage. MASTER’s foreign patient revenue mix is projected to reach 27% in 2024, 35% in 2025, and 35% in 2026, compared to 24% in 2023. The company targets a 50% foreign patient mix by 2027. Notably, pricing and margins remain similar for both Thai and international patients.

From a valuation perspective, MASTER is trading at 20x P/E for 2025 and 17x P/E for 2026. MASTER TB is well-positioned to capitalize on Thailand’s booming cosmetic surgery market. Its strategic focus on foreign patient expansion, combined with increasing capacity utilization and strong profitability, supports its long-term growth potential.

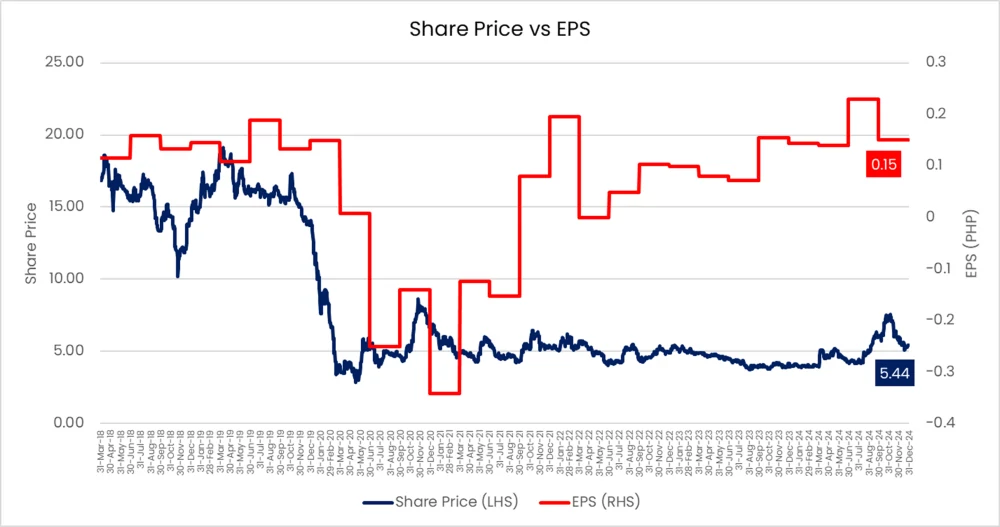

MacroAsia Corporation (MAC PM) Market Cap. PHP 10.2 bn; USD 173 mn

MacroAsia Corporation (MAC) reported 3Q/9M24 net income of PHP352m/PHP1.2b, reflecting a -3% decline for the quarter but a strong +61% YoY growth for the nine-month period. Excluding deferred revenues from the repricing of ground-handling rates, 9M24 core net income reached PHP976m, representing 72% of our full-year forecast. This performance was primarily driven by robust business volume growth across all segments, leading to a 22% YoY increase in total revenues.

The inflight catering and food segment, which accounts for 47% of total consolidated revenues, saw a +11% YoY increase to PHP3.3b, driven by higher meal sales volume of 17.4 million meals (+2% YoY). MAC is also expanding its commissary business, with ongoing facility upgrades in Sucat and a potential joint venture with Cebu Kitchen. Meanwhile, ground-handling services revenue (44% of total consolidated revenues) surged +37% YoY to PHP3.1b, fueled by an 8% YoY increase in flights handled (144,884 flights) and repricing of ground-handling rates for select accounts. Looking ahead, MAC is focused on expanding its cargo services, pursuing acquisitions, and strengthening its presence in Japan.

Lufthansa Technik Philippines (LTP), MAC’s Maintenance, Repair, and Overhaul (MRO) associate, reported 9M24 net income of PHP975.9m (+27% YoY), with MAC’s 49% share amounting to PHP478.2m. The growth was driven by a 26% YoY revenue increase to PHP12.6b, supported by the expansion of base maintenance services, including the ongoing Hangar 1A project in Manila and plans to establish new MRO facilities outside Manila.

MAC is currently trading at an attractive 6x PE for 2025 and 5x PE for 2026, highlighting further upside potential as the company continues to expand. With sustained revenue growth, strong contributions from LTP, and strategic expansions in catering, ground-handling, and MRO services, MAC remains well-positioned for continued earnings growth in the coming years.

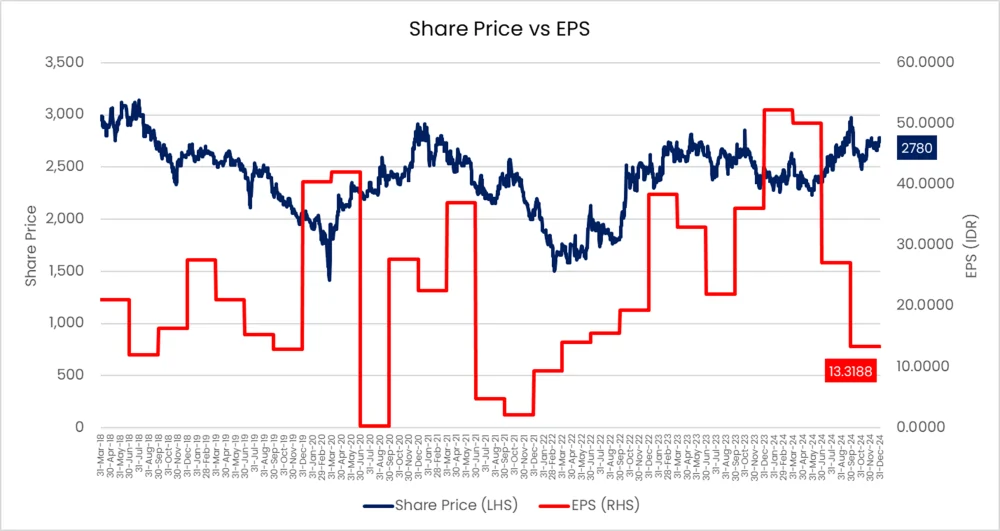

Jaymart Group Holdings (JMART TB) Market Cap. THB 16.8 bn, USD 484 mn

JMART and its subsidiaries have demonstrated a significant recovery in 2024. The consolidated financial statements for Q3/2024 report a net profit of 255.3 million baht, bringing the 9M24 net profit to 830.8 million baht. This marks a substantial turnaround from 9M23, where the company posted a loss of 613 million baht.

In the JMART mobile phone business, the distribution segment recorded a net profit of 66 million baht for 9M24, reflecting a 40.5% decline year-over-year due to intensified competition and a slowing economy. However, Q4/2024 is expected to be the strongest quarter of the year, driven by new mobile phone model launches in Q4/2024 and continuing into Q1/2025. Additionally, government stimulus policies are anticipated to support demand. The company is also benefiting from growth in Lock Phone financing, including Samsung Finance Plus and SG Finance Plus, further boosting sales momentum.

The JMT debt collection business, under JMT Network Services (JMT), continues to focus on improving cash flow collections through customer follow-ups and enhanced legal processes. For 9M24, JMT reported a net profit of 1,215 million baht, a 17.4% YoY decline, primarily due to higher expected credit losses (ECL) and rising financial costs. However, the trend is improving, as ECL levels declined in Q3/2024, leading to a 17.2% increase in net profit compared to Q2/2024. With Q2/2024 appearing to be the profit bottom, Q4/2024 is expected to be JMT’s most profitable quarter of the year.

Singer Thailand (SINGER) has shown a strong recovery, reporting a 9M24 net profit of 76 million baht, a 102.4% increase YoY. In the first half of 2023, SINGER faced significant losses due to provisions for non-performing loans and risk assessments, particularly related to the lingering effects of COVID-19. However, following operational adjustments and cost reductions, the company returned to profitability in Q3/2023. SINGER is actively implementing efficient debt collection strategies, including legal actions to recover non-performing debt. Furthermore, its subsidiary, SGC, has successfully entered the credit financing sector, focusing on controlled-risk Lock Phone financing, with loan disbursements increasing and NPLs remaining low.

JMART's strategic investments also continue to perform well, particularly its 30% stake in Suki Tee Noi. As of September 30, 2024, Suki Tee Noi had expanded to 73 branches, an increase of 6 branches QoQ, with a focus on expanding in provincial areas. This expansion has led to strong revenue and net profit growth, with JMART’s share of profit from Suki Tee Noi reaching 267 million baht in 9M24, representing a 35.5% increase YoY.

In terms of valuation, JMART is currently trading at 0.8x Book Value (BV), with projected Price-to-Earnings Ratios (PE) of 13x for 2025 and 10x for 2026. With a clear financial turnaround, improving profitability across key subsidiaries, and strategic growth in core businesses, JMART is well-positioned for continued recovery and expansion in the coming years.

Indosat Tbk PT (ISAT IJ) - Market Cap. IDR 76 trn; USD 4.6 bn

ISAT IJ is currently trading at a P/E of 11x for 2025 and 9.9x for 2026. Management has observed a positive trend in customer activity since October 2024, following macroeconomic challenges that impacted purchasing power in the first nine months of the year. Several positive developments in recent months have allowed Indosat Ooredoo Hutchison (IOH) to implement price increases, including a headline price adjustment and a reduction in monthly package validity from 30 days to 28 days, effectively raising prices by approximately 6.7%. Additionally, IOH has started passing on VAT to customers for low-denomination products (Rp 5k–20k), further optimizing revenue generation.

To enhance market positioning, IOH has decided to focus on a single brand in new markets, reallocating resources to expand its market reach more efficiently. The price gap between IM2 and Tri brands has also narrowed significantly, from 30-40% to below 10%, while the pricing gap between retail products and CVM/app-based offerings has also decreased as IOH expands its distribution network across Indonesia. This distribution expansion allows IOH to better monetize network quality improvements and subscriber growth.

Looking ahead, management remains committed to doubling EBITDA by 2028F, implying a 15% CAGR, which is significantly higher than the 8-9% CAGR projected by the capital market. A key driver for this growth is the company’s non-mobile business segments, which are expected to play a crucial role in bridging the gap between market expectations and IOH’s ambitious financial targets.

Mayora Indah Tbk PT (MYOR IJ) - Market Cap. IDR 58.8 trn; USD 3.6 bn

Mayora Indah (MYOR IJ) reported 3Q24 sales of Rp9.4tn, marking a +17% YoY increase, the highest quarterly sales in the company’s history. This brings 9M24 sales to Rp25.6tn (+12% YoY), driven primarily by strong volume growth. The average selling price (ASP) impact was +5% YoY in 3Q24 and +2-3% YoY in 9M24, reflecting moderate price adjustments. October 2024 sales grew by +20% YoY, with both local and export markets achieving similar growth. Notably, October 2024 recorded the highest monthly sales YTD, with a sequential MoM trajectory of Oct > Sep > Aug, signaling continued strong demand. While the blended ASP impact for October is pending final closing, key SKUs in coffee and cocoa-related products saw price hikes of ~10%.

Looking ahead, MYOR expects to achieve >12% YoY sales growth in FY24 and aims to sustain this momentum into 2025. While price adjustments remain a key focus, management prioritizes market share and sales volume over short-term profitability. The company projects a higher gross margin in 4Q24 compared to 3Q24, with sequential improvements continuing into FY25. The FY25 gross margin is guided at 23-26%, though management remains cautious about rising CPO prices, which have increased since September 2024. Advertising and promotion (A&P) spending is planned at 8-9% of sales in 2025, assuming sales growth exceeds 10% YoY.

MYOR continues to gain market share across key product segments. In 3Q24, the company’s biscuit market share rose to 43% (from 38% in 2Q24), candy stood at 21%, wafer increased to 24% (highest quarterly share), chocolate remained stable at 33%, and coffee held at 5%. Internationally, MYOR saw an increase in coffee market share in the Philippines (48% vs. 46% last year), while Malaysia’s biscuit and coffee segments are performing well, with plans for more aggressive expansion in 2025. Notably, MYOR’s biscuit market share ranking in Malaysia improved from #4 to #3.

The company also sees an opportunity to gain market share as competitors in Indonesia and the Philippines have increased prices for coffee and cocoa-related products. Valuation-wise, MYOR is trading at an attractive 15x PE 2025E and 12x PE 2026E while maintaining a strong net cash position, providing financial flexibility for future growth.

Singapore Post Ltd (SPOST SP) Market Cap. SGD 1.1 bn; USD 868 mn

SPOST was accumulated during the second half of 2024. It’s core business is best described as a post office company. However the company has expanded heavily throughout the country and Australia with acquisitions. Under a new mandate by the Board the Company appears to be focused on divesting non-core businesses implying that the potential for dividends could equal its market capitalisation over the next two years.

Recently, SPOST has agreed to divest its Australia business for AUD1.02bn to Pacific Equity Partners, generating a gain on disposal of SGD312.1m. This transaction significantly strengthens SPOST’s balance sheet by reducing total debt from SGD895m to SGD350m, cutting interest expenses, and boosting liquidity. Given that the financing cost of its Australian debt was approximately 5%, compared to just 3% for its SGD-denominated debt, this move will lead to improved profitability. With the completion of the sale, SPOST’s cash balance will increase to SGD1.3bn, more than its SGD1.1bn in total debt, resulting in a net cash position of SGD0.2bn.

Rather than reinvesting the proceeds, SPOST is likely to return a significant portion to shareholders, with dividends over the next two years expected to exceed the current share price. This outlook is reinforced by the company’s commitment to further monetise non-core assets, including its freight-forwarding business (Famous Holdings), SPOST Centre, and various self-owned post offices. Famous Holdings is estimated to be worth SGD80-100m, while SPOST Centre’s market value is approximately SGD1.2bn. Meanwhile, a major post office network restructuring is underway, with plans to reduce the number of post offices by more than 50% and shift services to MRT stations and supermarkets, unlocking additional value from property assets.

The local postal business remains a challenge, but cost optimisation efforts, including higher postage fees and outlet closures, should help drive profitability. As asset monetisation continues, SPOST is expected to return up to SGD0.86/share in dividends, a significant premium to its current valuation.