Musings

USD 10 billion for Amazing Thailand & Indonesian sweetness

Thailand is continuing its well-trodden tradition of changing Prime Ministers. The comical nature of the country's management rivals its sappy TV soap operas that capture the populace's attention. Now, they’re offering up USD 10 billion in stimuli to make up for the past decade.

With the return of Thaksin Shinawatra as Prime Minister, the appointment of Paetongtarn Shinawatra as the latest Prime Minister of Thailand, the government, in a sudden stroke of memory, has decided to acknowledge the 90% of the working population struggling below the poverty line after a decade of "stellar" governance by rolling out a cash handout scheme. And let's not forget the suffering investors in Thai equities - don’t worry, they've got us covered too. The newest Vayupak fund scheme is here, because clearly, throwing money at problems has worked so well in the past.

Nevertheless, these policies are a combined total of USD 10 billion of stimulus which is incredibly positive for the Thai equity market in the short-medium term.

The THB 10,000 digital cash handout.

Initially proposed to stimulate the local economy and promote digitalisation by providing THB 10,000 (approximately USD 300) to all Thai citizens aged 16 and older.

The new administration, led by Prime Minister Paetongtarn Shinawatra, has reassured citizens that the campaign will move forward regardless of the change in leadership. If approved, the money will be directly transferred into bank accounts by September, starting with 'vulnerable groups,' which includes approximately 14 million people. This approach ensures that those most in need will benefit first and the money may be used for any purpose.

The government will start transferring THB 10,000 each to an estimated 14.6 million beneficiaries from 25th September. The beneficiaries include 12.4 million state welfare cardholders and 2.15 million people with disabilities.

Sources:

Vayupak Fund

In short, the latest Vayupak Fund, a state investment Fund, is a massive influx of capital of THB 150 billion or USD 4 billion into Thai capital markets.

The Fund aims to raise THB 100-150 billion, with subscriptions beginning in September and proceeds are expected to begin deploying in October 2024.

VAYU1 will have a 10-year holding period and will pay dividends twice a year based on actual returns. There is a minimum dividend payout of 3% and a maximum of 9% per year. There is also an investment protection mechanism in place to return principal at maturity. Investors will receive their principal back in full if the total net asset value (NAV) of the fund does not fall below Bt150bn (from a total fund of Bt500bn). This implies that the investment portfolio would need to be reduced by about 70% from the total NAV, or approximately Bt500bn (Bt350bn from the existing fund + Bt150bn new funds) after fundraising from the public. For the investment policy, the fund’s weighting will be 50% in SET stocks, 40% in bonds, and 10% in corporate debentures.

Sources:

- https://www.bangkokpost.com/business/investment/2862482/vayupak-fund-offering-starts-soon

- https://thestandard.co/10-things-vayu1/

- https://www.bangkokbiznews.com/finance/stock/1143841

New Holdings

Dusit Thani (DUSIT TB) Market Cap THB 9.69 bn, USD 286.2 mn

Dusit Thani is a leading hospitality company in Southeast Asia with over 75 years of experience in the industry. The company operates across five distinct yet complementary business segments: hotel management where it owns and manages over 300 properties, including hotels, resorts, and luxury villas. Its brands include Dusit Thani Hotels and Resorts, Dusit Princess Hotels and Resorts, dusitD2 Hotels and Resorts, Dusit Devarana Hotels and Resorts, and ASAI Hotels; education, operating educational institutions that offer programs in hospitality management, culinary arts, and other related fields; hospitality-related services such as spa and wellness services through its Devarana Wellness brand, and food operating several food and beverage outlets, including restaurants and cafes, showcasing Thai and international cuisines.

The key thesis for holding DUSIT is the upcoming completion of Dusit Central Park, a THB 46 billion value mixed-use project in Bangkok CBD which comprises of a shopping mall (85% owned by Central Pattana Plc), an office building (100% owned by DUSIT, scheduled to open in 2H25), a hotel (70% owned by DUSIT and due to open this month), and a residential condominium (70% owned by DUSIT, due to be completed in late 2025).

We accumulated the shares in 1Q24, DUSIT is currently a 4% weighting in the Fund.

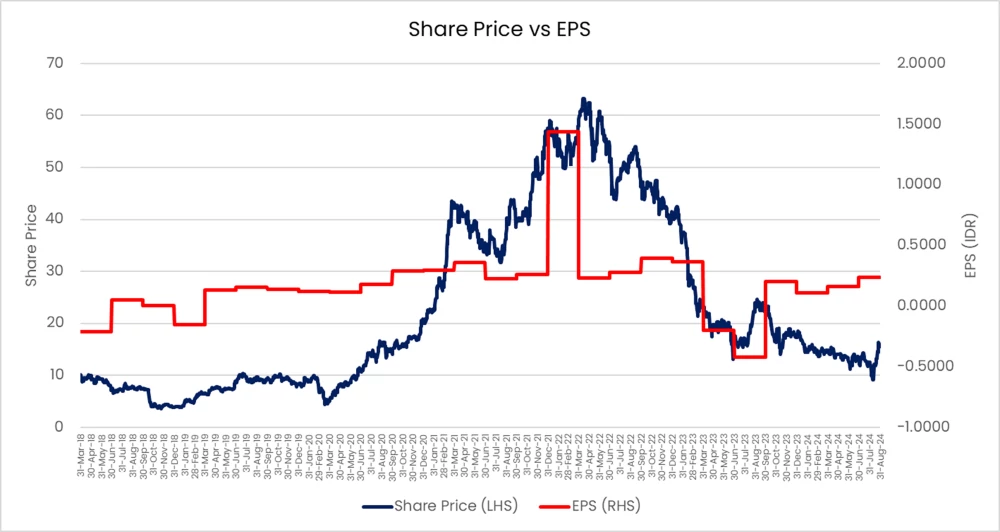

Jaymart Group Holdings (JMART TB) Market Cap THB 24 bn, USD 709 mn

JMART TB is a holding company whose core primary line of business is retail and wholesale distribution of mobile phones, gadgets, and IT products. What drives the value of the company are its holdings in companies such as JMT Plc (54%; THB 27 bn mkt cap), Thailand’s largest private Asset Management Company for debt collection and management, Singer Thailand (25%; THB 10 bn mkt cap) a consumer financing company and several other stakes in companies such KB J Capital, the Samsung+ financing arm in Thailand, as a property developer, JAS Asset, and Suki Tee Noi, the fastest growing F&B chain in Thailand.

During the 2H22 to 1H23, the Company’s profitability declined markedly due to a write-off at SINGER and the liquidity tightness in Thailand leading to JMT reporting slower than expected growth. These developments led to a loss of THB 447 mn in 2023, and during the 1H24 the PE of JMART was as high as 200x, however, the past 4 quarters have seen the company return to profit. For the 1H24 earnings have returned to THB 575 mn, and we expect that the earnings will continue to surpass expectations for the rest of the year and 2025, combined with several positive catalysts likely to come from its holdings such as a potential IPO of Suki Tee Noi in 2025, an improvement in growth for the debt collection business of JMT and renewed business progress in SINGER.

We accumulated the shares during the 1H24, JMART TB is currently a 7% weighting in the Fund.

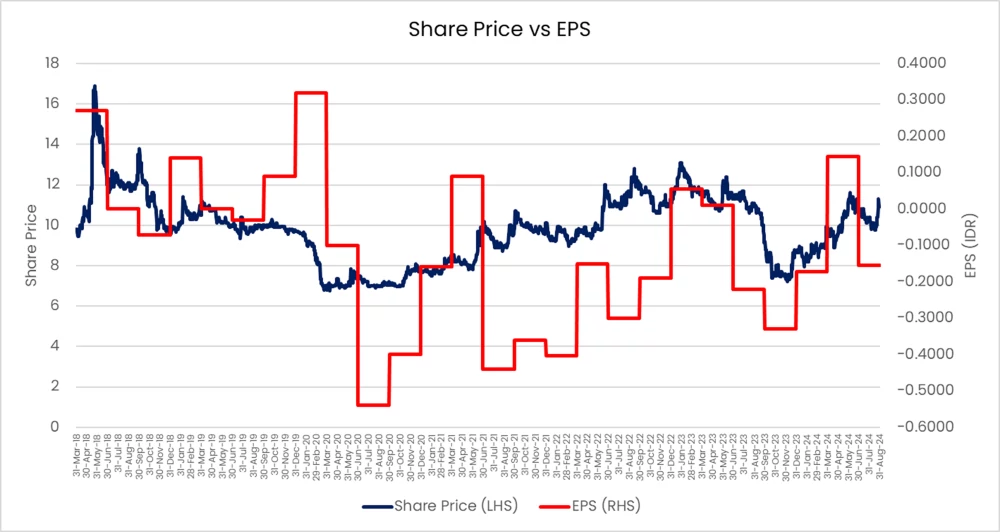

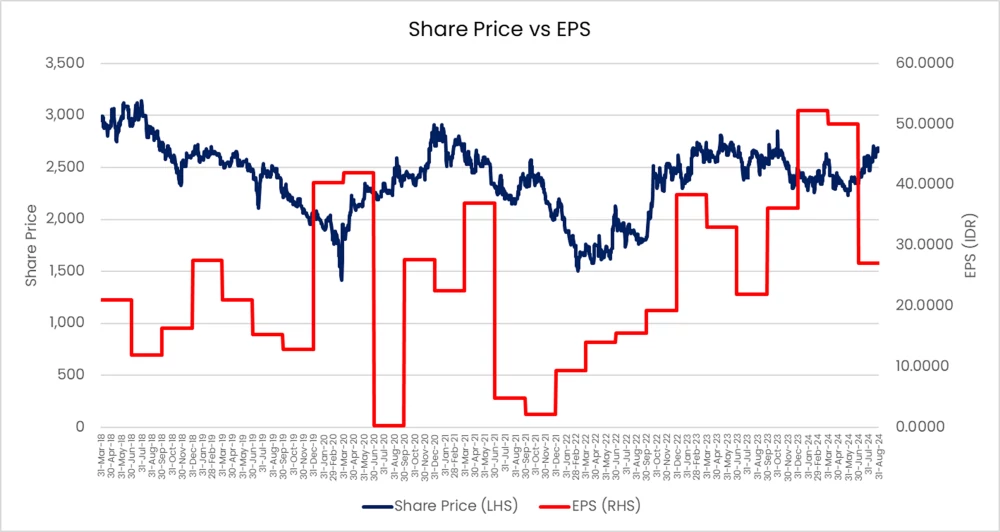

Mayora (MYOR IJ) Market Cap IDR 60.82 trn, USD 3.94 bn

MYOR IJ is one of the largest and fastest growing FMCG exporters in Indonesia. Its export sales have grown positively annually since 2009, aside from 2020, at a CAGR of +21%, currently export sales are 44% of total sales. The company is the market leader in the Philippines (instant coffee and breakfast cereal), China (butter cookies), Lebanon (instant coffee), and Thailand (biscuits).

Domestically they are dominant, especially in biscuits (42.4% market share in 2023 vs. 27.7% in 2015), wafer (22.6% shares in 2023 vs.5.1% in 2015), and breakfast cereal (69% shares in 2023) categories. This is driven by having one of the largest store coverage levels at close to 1 mn point of sales, and strong general trade distribution (~85% of sales).

We accumulated the shares at the beginning of the 3Q24 as 1) on the expectation that their 2Q24 earnings would be strongly positive, which ended up being the case as domestic sales grew strongly at +20% while exports rose +14% YoY and 2) that it has an ROE of 25% and PE25 of 15x

MYOR is currently a 5% weighting in the Fund.

Media

Thailand versus Vietnam

In July 2024, on LongtunMan’s investment show, we said that Thailand’s equity market had a higher probability of outperformance versus the Vietnamese market.

This is evident in our holdings with 10x higher weighting in Thailand equities (25%) versus Vietnamese equities (2.5%).

And in August, Thailand was the best performing market in the region.

Link: Thai Stocks Set For Best Day Since 2020 as Policy Risks Fizzle - Bloomberg

Disclaimer: Data as of 30 August 2024

Tickers Mentioned

DUSIT TB - Dusit Thani PCL

JMART TB - Jaymart Group Holdings PCL

MYOR IJ - Mayora Indah Tbk PT